Data ReFined #31: Voluntary Carbon Offsets, UN's Climate Risk Report, $60M to Scale Parametric Insurance

The Newsletter about Climate Data, Regenerative Finance, and Climate Risk ⛅

The demand for carbon credits is quickly growing, and this biweekly newsletter covers the latest industry updates, including news regarding scope 3 emissions and market interest in offsets from Kenya. This issue also contains exciting developments on the climate risk management side, such as Arbol's $60M Series B funding round to scale parametric insurance and a report by the United Nations.

Let's get into it! 👇

Subscribe here for more updates!

Industry News

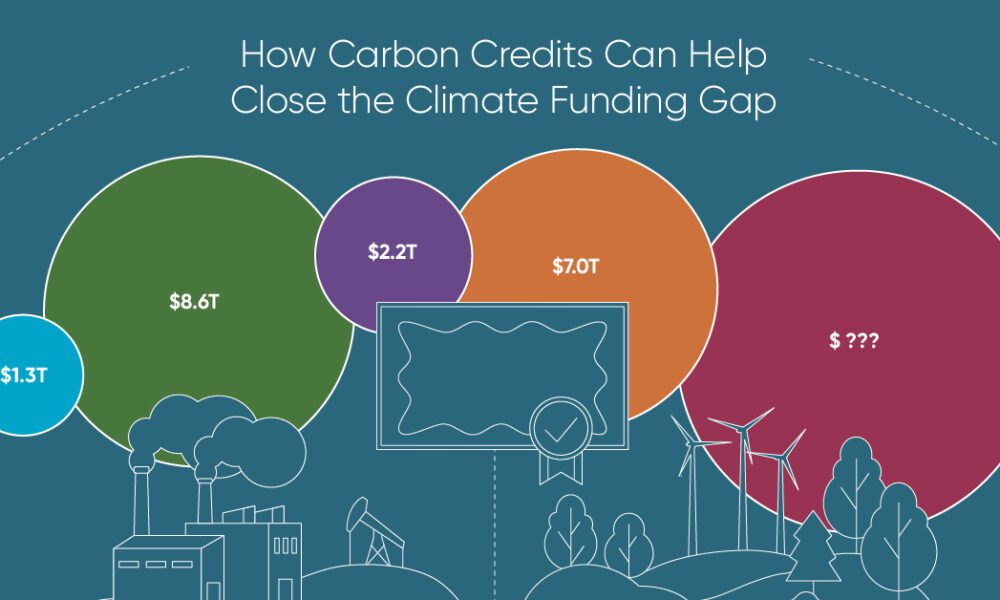

A Visual Journey into the Carbon Markets

This Visual Capitalist article offers a detailed look at the global carbon markets through various infographics. It showcases the geographical distribution of carbon credit buyers and sellers and provides projections of the voluntary carbon market's size by 2030.

Tackling Scope 3 Emissions with Voluntary Carbon Offsets

The Science Based Targets initiative (SBTi) is set to significantly boost the voluntary carbon market by allowing broader use of offsets to neutralize Scope 3 emissions. This change, expected to enhance market quality and substantially increase demand, could see annual offset demand potentially reaching 5.9 billion tons and prices peaking at $243 per ton by 2050.

A Deep Dive into Kenya's VCM Dynamics

Kenya's booming voluntary carbon market makes it Africa's second-largest issuer of carbon credits, after the Democratic Republic of Congo. A contributing factor to this success is Kenya's strategies to enhance transparency and regulation within this market, including proposals to funnel a portion of carbon credit sales revenue to governmental support.

United Nation's 2024 Report on Climate Risk

The UN Environmental Programme published its latest insights for financial institutions to evaluate physical and transitional climate risks. The report includes best practices, case studies, and strategies for navigating the market of climate risk tools. It also provides updates on regulatory changes related to climate disclosures and recent developments in the market.

Scaling Climate-Related Parametric Insurance

Arbol has secured $60 million in a Series B funding round, accelerating the insurtech's growth trajectory and capacity to broaden its product and service offerings across existing and new markets.

Physical Climate Risks in the Financial Industry

The financial industry is increasingly aware of the economic impacts of climate change, such as potential loan losses due to extreme weather events. Banks are focusing more on climate-related physical risks, improving risk assessments, and adjusting lending practices to manage environmental impacts better and ensure financial stability.

European Union's Regulation on Deforestation-free Products (EUDR)

Several European Commission bodies are developing educational resources, including workshops, to help stakeholders utilize the extensive climate datasets from Copernicus for the new EUDR framework. These initiatives aim to equip key actors with the necessary tools to monitor forest health and assess policy effectiveness on both European and global scales.

Forecasting Satellite Movements with Climate Models

Researchers at the University of Helsinki have discovered that modern weather prediction models can accurately forecast the movements of low Earth-orbiting (LEO) satellites based on energy emitted and reflected by the Earth. These findings show how changes in weather, such as cloud cover and storms, can influence satellite trajectories, enhancing satellite operations and the accuracy of climate monitoring.

Thank You For Reading Our Newsletter! 💙

Your interest and support mean a lot to us! If you enjoyed this content, please share this newsletter with your network to increase awareness of these important subjects.

Please join the conversation on social media, where we welcome your comments, feedback, and likes! 👇

Connect with us on Twitter | LinkedIn | Discord | Telegram | YouTube

Learn more about the decentralized and open climate data ecosystem we are building via the links below!

🌐 Visit our website

👉 Check out our products

💽 Explore 40+ TB of free climate data via our data marketplace and API