Use Cases for Physical Climate Risk Assessment: A Comprehensive Overview

As climate change advances, its repercussions are becoming increasingly tangible, impacting various sectors of the global economy. Whether it's the real estate industry grappling with rising sea levels or the agriculture sector contending with changing precipitation patterns, climate change is no longer a distant threat but a present reality. In this context, physical climate risk assessment is emerging as an essential tool for businesses and investors alike, allowing them to understand, mitigate and adapt to these changes.

Who Needs Physical Climate Risk Assessment?

Banks, Financial Institutions and Investors

Investors also have a vested interest in understanding physical climate risk. As climate change can significantly impact the profitability of businesses, investors need to consider these risks when making investment decisions.

For instance, an agricultural investment could be less profitable in an area projected to experience increased droughts. Moreover, asset managers can benefit from using risk assessment solutions, as it brings more insights into ESG metrics and the associated risks for investors of those portfolios. Finally, banks and other financial institutions can use physical risk assessments for compliance needs such as the TCFD or commercial lending.

Physical climate risk assessments can thus provide valuable insights into the potential long-term return on investments for various stakeholders in the financial sector.

Insurance Companies

For insurance companies, the stakes are perhaps even higher. These companies need to accurately price the risk associated with different types of insurance policies. Understanding the physical risks posed by climate change to the assets they insure is thus crucial. This information can help insurers adjust their models and pricing strategies to better reflect reality, ensuring their long-term viability.

Corporations

Large corporations, particularly those with substantial physical assets, are primary candidates for physical climate risk assessment. This includes companies in the infrastructure, manufacturing, energy, agriculture, and tourism sectors, among others. Assessments can help identify potential vulnerabilities in their operations, supply chains, and physical assets, thus enabling them to devise targeted mitigation strategies.

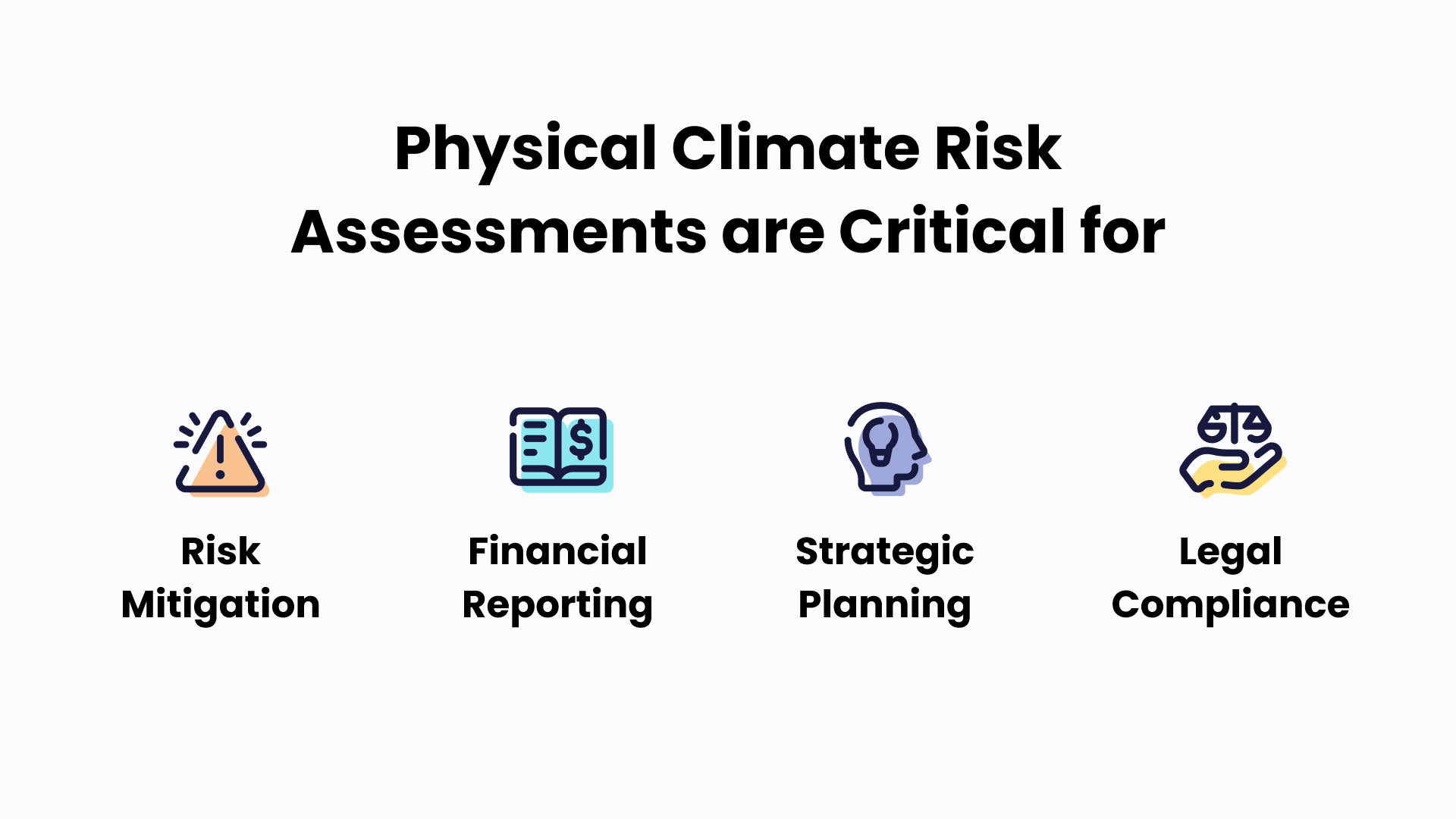

Why is Physical Climate Risk Assessment Needed?

Physical climate risk assessments are critical for several reasons:

Risk Mitigation

Understanding physical climate risks allows businesses and investors to take proactive measures to mitigate these risks. This could include altering business operations, investing in protective infrastructure, or diversifying investments to minimize exposure to high-risk areas.

Financial Reporting

Companies are under increasing pressure from regulators, investors, and consumers to disclose their climate-related risks. Physical climate risk assessments can provide the necessary data to support transparent and accurate reporting.

Strategic Planning

By identifying potential climate risks, businesses can develop more resilient strategic plans. They can use this information to guide decisions about where to locate new facilities, which markets to enter, and how to manage supply chains effectively.

Legal Compliance

As climate change continues to impact economies globally, regulators are implementing more stringent laws regarding climate risk disclosure. Assessments can help businesses stay compliant and avoid potential fines and legal issues.

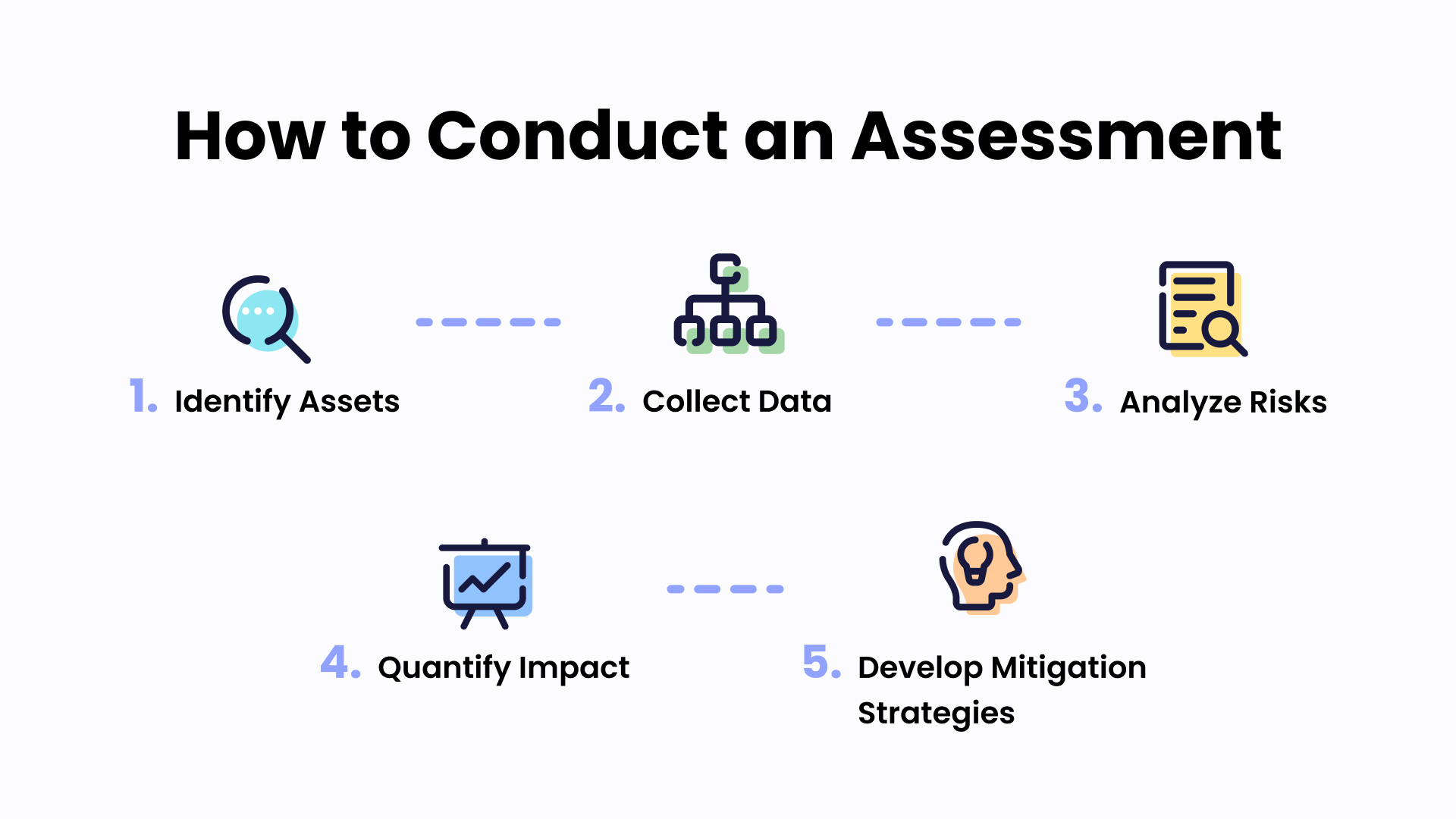

How to Conduct a Physical Climate Risk Assessment

A comprehensive physical climate risk assessment involves several steps:

- Identify Assets: Start by cataloging all physical assets. This could include buildings, infrastructure, supply chains, and any other assets potentially at risk from climate events.

- Collect Data: Gather relevant climate data, such as historical weather records, climate projections, and geographic information about the locations of the assets.

- Analyze Risks: Use this data to evaluate the specific risks associated with each asset. This could involve modeling different climate scenarios to understand how each would potentially impact the assets.

- Quantify Impact: Translate these risks into financial terms. This involves determining the potential cost of asset damage, business disruption, supply chain issues, and other impacts.

- Develop Mitigation Strategies: Based on the assessment's findings, develop and implement strategies to mitigate identified risks. This could include physical measures, such as installing protective infrastructure, or operational changes, such as diversifying suppliers.

While conducting physical climate risk assessments can be complex, the insights they provide are invaluable. They empower businesses, investors, and insurers to not only survive in a changing climate but to thrive, by turning risks into opportunities.

Conclusion

In conclusion, physical climate risk assessments are becoming an essential element of modern business operations, investment strategies, and risk management. Given the urgency and complexity of climate change, leveraging these assessments is not only a smart business decision but a necessary one for future-proofing against the uncertainties of a warming planet.

As our understanding of climate risks continues to evolve, so too must our approaches to managing these risks. Stay tuned to our blog for more discussions on emerging trends and innovative solutions in the field of climate risk assessment.

Learn more about why physical climate risk assessment matters, especially for corporations and institutions, in this blogpost.

- Explore our Data Marketplace with over 40 TB of free climate data

- Visit our Website, Blog, REST API and Documentation

- Sign up for our bi-weekly Newsletter

- Join the Community: Twitter | LinkedIn | Discord | Telegram | YouTube