Price Dynamics in the Voluntary Carbon Market

Catalyzing Environmental Impact through the Voluntary Carbon Market

The Voluntary Carbon Market (VCM) and its mitigation impacts have been identified as one of the solutions to help the world achieve its ambitious environmental and sustainable goals. By facilitating investments in diverse projects - from enhancing energy efficiency with cookstoves in Kenyan villages to expansive forest conservation through REDD+ programs in the Democratic Republic of Congo - the VCM generates quantifiable and verifiable environmental benefits, bolsters biodiversity, and uplifts local and indigenous communities. Beyond philanthropy, these initiatives become financially viable through carbon finance, realized by issuing carbon credits, i.e., the tradable commodity arising from these projects. These credits, embodying the tangible outcomes of environmental projects, play a crucial role in the global strategy to mitigate climate change.

Deciphering the Carbon Credit Marketplace

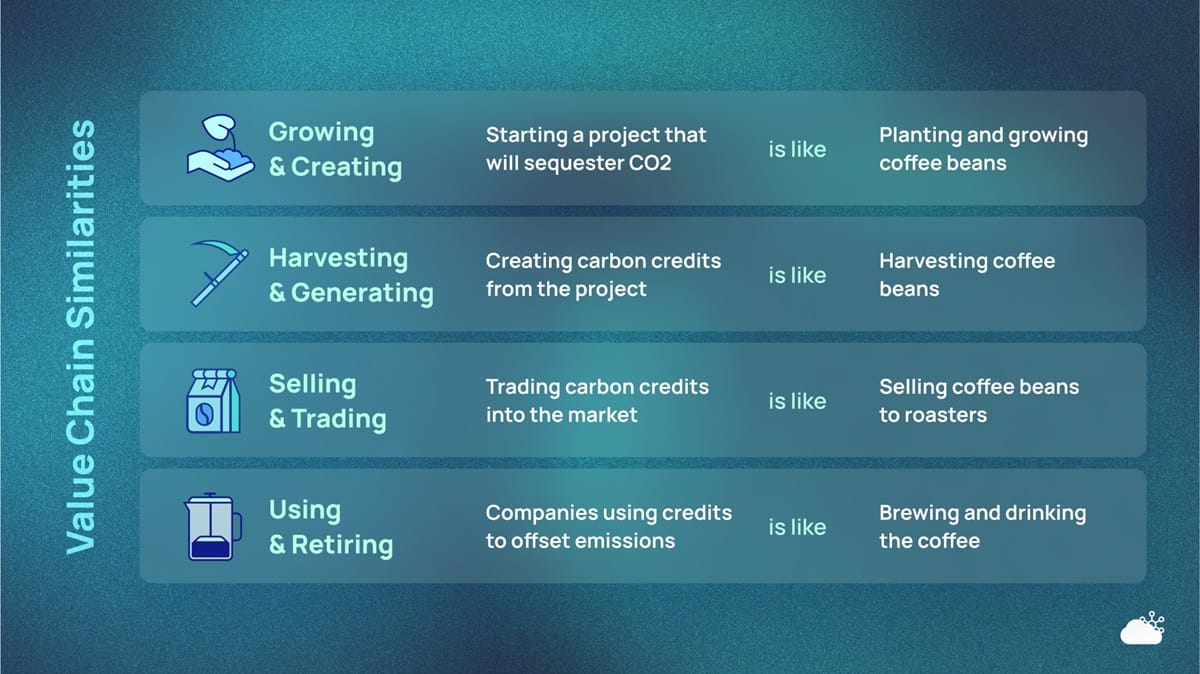

Mirroring the dynamic of traditional commodities like coffee or cocoa, carbon credits navigate the market through a diverse network of participants. This ecosystem comprises project developers, acting as "producers" that produce/create carbon credits generated through these environmental initiatives; traders and off-takers, enhancing market liquidity and managing risks; brokers, facilitating and streamlining the buying and selling process; financial institutions, providing capital or seeking returns; and corporations integrating these credits into their net-zero strategies.

Even though many different players are involved in the VCM market, again similar to more traditional commodities such as coffee or cocoa, carbon credits are not just bought and sold. Carbon credits can and are "consumed" or retired. Retiring a carbon credit, i.e., consuming it, happens when a company buys a carbon credit to offset its emissions (ideally as part of a company-wide carbon footprint reduction strategy). This retirement is similar to using electricity one buys to power their EV or to the coffee bean that has been roasted, ground, and ultimately brewed.

The Value Chain: from Production to Consumption

Continuing the analogy with traditional commodities, carbon credits are traded and exchanged between buyers and sellers, as described above. Each carbon credit represents 1 ton of carbon dioxide equivalent (CO2e) that has been avoided, reduced, removed, or sequestered. While the amount of carbon a credit represents is always the same, the price of a carbon credit can vary greatly depending on several factors:

- Project Cost (Abatement Cost): Like traditional commodities emerging from production processes, carbon credits are generated from nature-based or technologically-based projects also undergoing a production process. These projects incur various development costs, including materials like seedlings, labor, equipment, monitoring, reporting, verification (MRV), certification, and fees for standards or registries. The abatement cost, essentially the unit cost of a project, is calculated by dividing the total project cost by the expected emission reductions. Often overlooked, the abatement cost is an essential component of the initial price determination of a carbon credit. It will also determine the investor's return on investment, comparing the abatement cost of a project (or a portfolio of projects) to the expected sales price (spot or forward).

- Project Type: Carbon credits derived from nature-based solutions, such as wetlands restoration, are often priced higher than those from specific technology-based initiatives, like renewable energy projects. This reflects the additional environmental and social benefits these nature-based projects typically offer over renewable energy projects.

- Removal vs. Avoidance: Carbon credits that contribute to directly removing CO2 from the atmosphere (removal credits) are generally deemed more valuable than those that prevent emissions (avoidance credits). This distinction underscores the increasing demand for solutions that reduce atmospheric carbon levels.

- Jurisdiction: regulatory environment (compliance vs. voluntary only, taxes, political instability, etc.), local project development costs, market demand dynamics, can significantly influence the price of a carbon credit.

- Vintage: The age of the credits plays a significant role in their valuation. Carbon credits from more recent projects are usually more expensive, reflecting the contemporary relevance and stricter verification standards they adhere to.

- Co-benefits: Carbon credits offering supplementary advantages (via additional certification such as CCB under Verra), such as biodiversity conservation or enhancements to local communities, can command a higher price. These co-benefits add significant value, aligning with broader sustainability goals and appealing to buyers looking to maximize their positive impact.

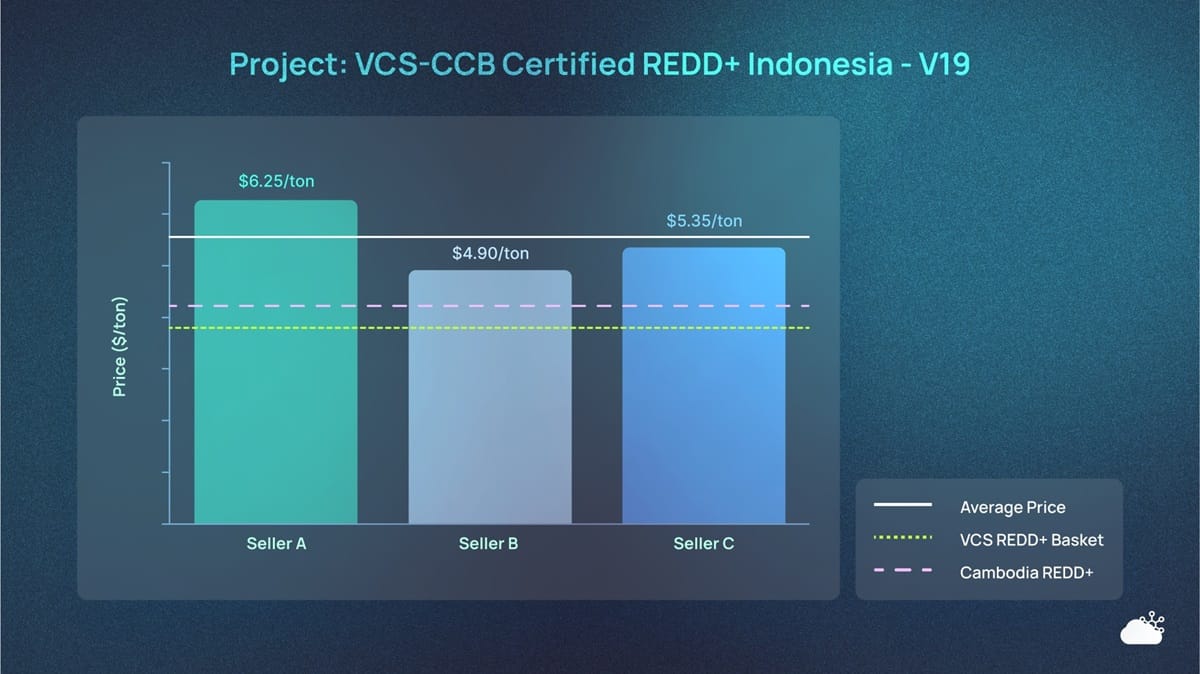

As of today, most, if not all, transactions are over the counter (OTC), meaning buyers and sellers negotiate prices directly. While we have seen the emergence of several and reliable OTC pricing sources (typically brokers or other data aggregators and providers such as Quantum Commodity Intelligence, Carbon Pulse, Viridios AI, Platts Live, or MSCI Carbon Markets), these remain heavily dependent on what buyers and sellers will report and will be based on specific transactions done on a particular project. This can lead to a variety of reported prices for either a single project or a basket of projects within the same category.

The Price is Right?

The predominance of OTC transactions within the VCM market introduces complexities in the price discovery process. Essential in mature markets such as traditional commodities, this process for establishing market prices through buyer and seller interactions, and influenced by supply and demand dynamics, faces scrutiny for its efficiency. Evaluating this efficiency can involve examining the consistency of pricing for a single project (or a basket of similar projects) across various sources or considering the role of exchanges that utilize standardized contracts as benchmarks for transactions. Platforms and exchanges like CBL/CME or CIX aim to normalize this landscape by offering harmonized contracts that enhance transparency and accessibility for all market participants. Despite these efforts, a significant discrepancy persists between OTC and exchange-listed prices, underscoring the market's continued reliance on OTC mechanisms and highlighting the challenges in achieving a cohesive price discovery framework.

OTC vs. Exchange-based Prices: Correlated but Disconnected

The opaque nature of OTC transactions - where contracts are privately negotiated and pricing details or references remain confidential - directly influences the margins applied in carbon credit transactions. Margins typically reflect the maturity of a market: nascent markets often exhibit wider margins due to the lack of readily available pricing sources and fewer participants, leading to less competitive pricing. Conversely, in more mature markets, the abundance of participants and the use of standardized transaction mechanisms tend to compress margins, demonstrating a more efficient market dynamic. In the VCM market, which is still considered nascent, OTC transactions may contribute to sellers applying wider margins, taking advantage of either the lack of price reference or the disconnect between exchange-based and OTC prices.

However, despite the advantages of transparency and standardized pricing, transactions on exchanges are surprisingly scarce. This scarcity undermines the effectiveness of the price discovery process, which is pivotal for determining fair market prices through supply and demand dynamics. An efficient price discovery process fosters project investments by ensuring long-term offtake contracts. It provides off-takers and investors with a dependable price benchmark and a mechanism to hedge against price volatility, thereby helping bridge the gap between the initial funding of projects and the issuance of carbon credits.

Carbon Credits: an Existing Asset Class in Need of Standards

The VCM market is expected to play a crucial role in achieving global climate objectives, as evidenced by the positive outlook and growth potential. Amid intensifying scrutiny of Environmental, Social, and Governance (ESG) commitments by both corporates and financial institutions, the VCM market has emerged as a new asset class, offering investors the opportunity to realize financial returns by investing in environmentally beneficial projects. However, unlike more established markets, the VCM market is characterized by a fragmented transactional framework.

A transformation towards a transparent and more robust pricing infrastructure could significantly contribute to channeling essential investments into these projects effectively without compromising their inherent benefits. Although bilateral negotiations in carbon credits trades aren’t inherently limiting, the importance of transparency parallels its role in monitoring, reporting, and verifying emission reductions of projects, proving critical in price discovery. By improving transparency, we strengthen the credibility of the VCM market and institutionalize its processes, thereby enabling a more efficient distribution of resources in pursuit of shared environmental objectives.

🌐 Check out our website, products, and blog

💽 Explore 40+ TB of free climate data via our data marketplace and API

📰 Sign up for our bi-weekly newsletter

🥳 Join the community: Twitter | LinkedIn | Discord | Telegram | YouTube