J-REDD+ and Pay-to-Preserve Schemes

REDD+: at the Origin of Forest Preservation

The voluntary carbon market (VCM) offers several tools to help combat climate change and its negative impacts on the environment, natural habitats, biodiversity, and local communities. These tools are commonly referred to as nature-based solutions, or NbS, such as afforestation, reforestation, or wetlands restoration projects, and technology-based solutions, or TbS, such as clean cookstoves distribution, biochar production, or direct air capture technology. Among these various and impactful approaches, one particular NbS initiative has drawn a lot of attention in recent months: REDD+ projects, and more specifically project-based REDD+ initiatives.

REDD+ was initially created as a voluntary climate change mitigation framework developed by the United Nations Framework Convention on Climate Change (UNFCCC) and originated from the increasing recognition of the critical role forests play in mitigating climate change. The concept evolved during the early discussions on Reducing Emissions from Deforestation (RED) at the 11th Conference of the Parties (COP 11) to the UNFCCC in Montreal in 2005. The "+" was later added to include forest degradation and the role of conservation, sustainable management of forests, and enhancement of forest carbon stocks.

REDD+ Modus Operandi

A REDD+ project functions by identifying forested areas at risk of deforestation or degradation due to illegal logging or unsustainable farming practices and implementing strategies to preserve and enhance these ecosystems, such as enforcement of environmental policies or capacity building and knowledge sharing in coordination with local communities. Before launching a REDD+ initiative, a project developer thoroughly assesses the project area to establish a baseline of the forest's current carbon stock. This involves calculating the amount of carbon emissions the forest would emit if it were deforested or degraded, using established methodologies for measuring, reporting, and verifying (MRV) these emissions.

These conservation activities help to prevent the predicted deforestation or degradation, thereby avoiding the associated carbon emissions. The difference between the baseline emissions and the actual emissions post-project implementation represents the amount of carbon dioxide equivalent (“CO2e”) that the project has successfully prevented from entering the atmosphere. These emissions reductions can then be quantified (or monetized) as carbon credits, with one credit representing one ton of CO2e emission avoided. These credits can be sold on the voluntary carbon market, providing financial incentives for continued forest conservation while offering investors and buyers a mechanism to offset their unabated or hard-to-abate carbon emissions. Through this model, REDD+ projects and their stakeholders strive to contribute to the global effort to mitigate climate change by preserving critical carbon sinks, enhancing biodiversity, and supporting local communities dependent on forest resources.

REDD+ projects have faced several issues related to data integrity and quality of carbon credits (i.e. projects underdelivering on their promises). These challenges have been recognized by market participants, ranging from standards bodies to project developers and end-buyers, prompting a recognized shift towards improving Measuring, Reporting, and Verification (MRV) tools and adopting innovative digital MRV (dMRV) solutions. However, and despite being the subject of several recent controversies, REDD+ projects remain a dominant force in issuing and retiring carbon credits, highlighting its critical role in global climate mitigation efforts.

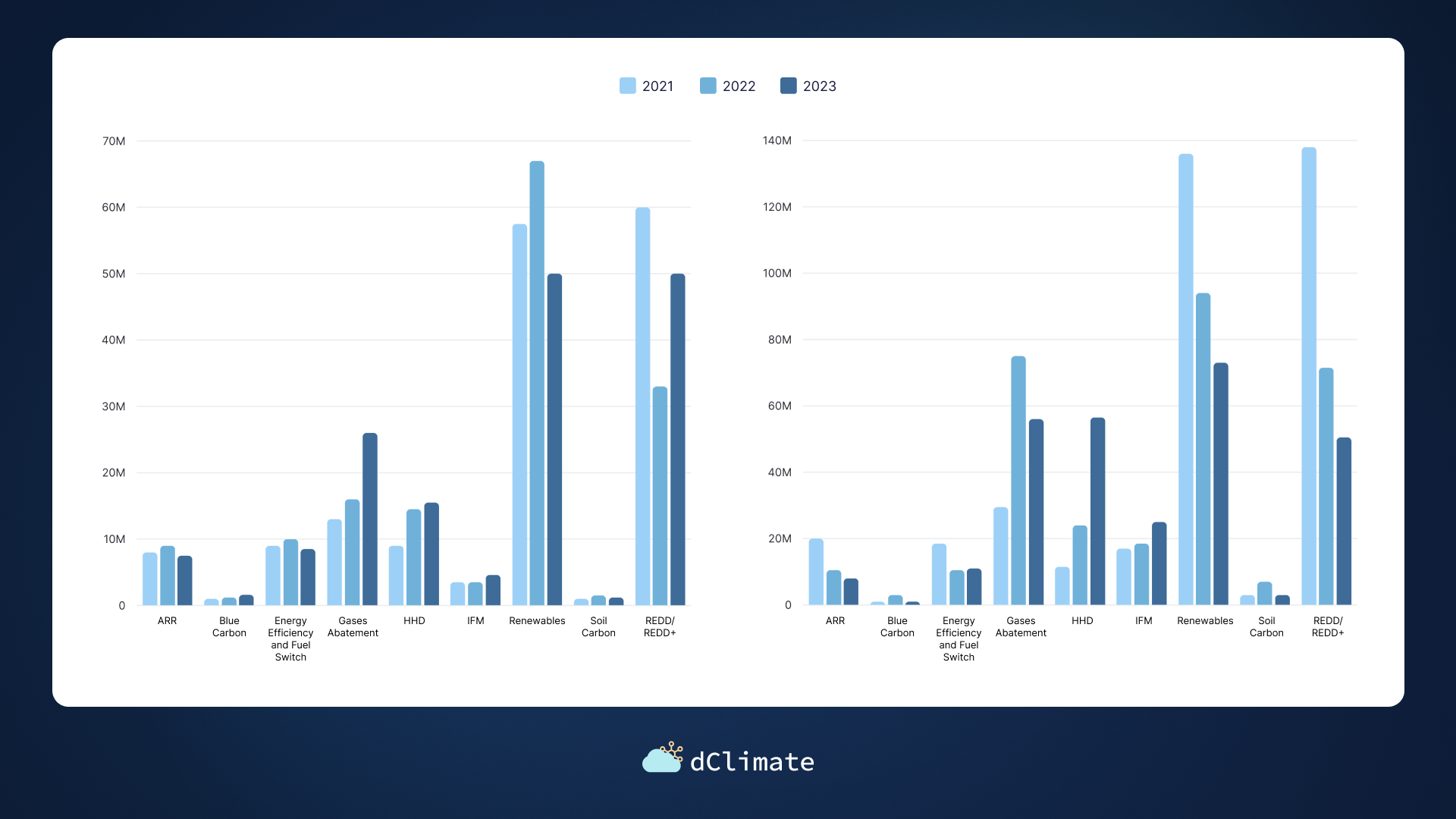

Carbon Credits Retirements (left-chart) and Issuance (right chart) by Project Type

Pay to Preserve Financing Scheme: Addressing Leakage Concerns

The REDD+ framework is designed to combat climate change by conserving forested regions, by employing internationally recognized, well-established, and continuously evolving methodologies. However, a significant challenge has been "leakage", where protection efforts in one area inadvertently cause deforestation and degradation activities to move to another area, undermining the net benefits of targeted emissions reduction.

The Jurisdictional REDD+ (J-REDD+) framework was introduced as a potential solution to leakage. Unlike traditional project-based REDD+ initiatives, Jurisdictional REDD+ applies a more holistic approach by considering all forest-related emissions and reduction efforts across a larger area, whether national or sub-national, often with the active involvement of the local government. This method aims to ensure that leakage within the designated jurisdiction is accounted for, aiming to provide a more accurate and impactful assessment of emissions reductions and enhancing the overall effectiveness of REDD+ initiatives.

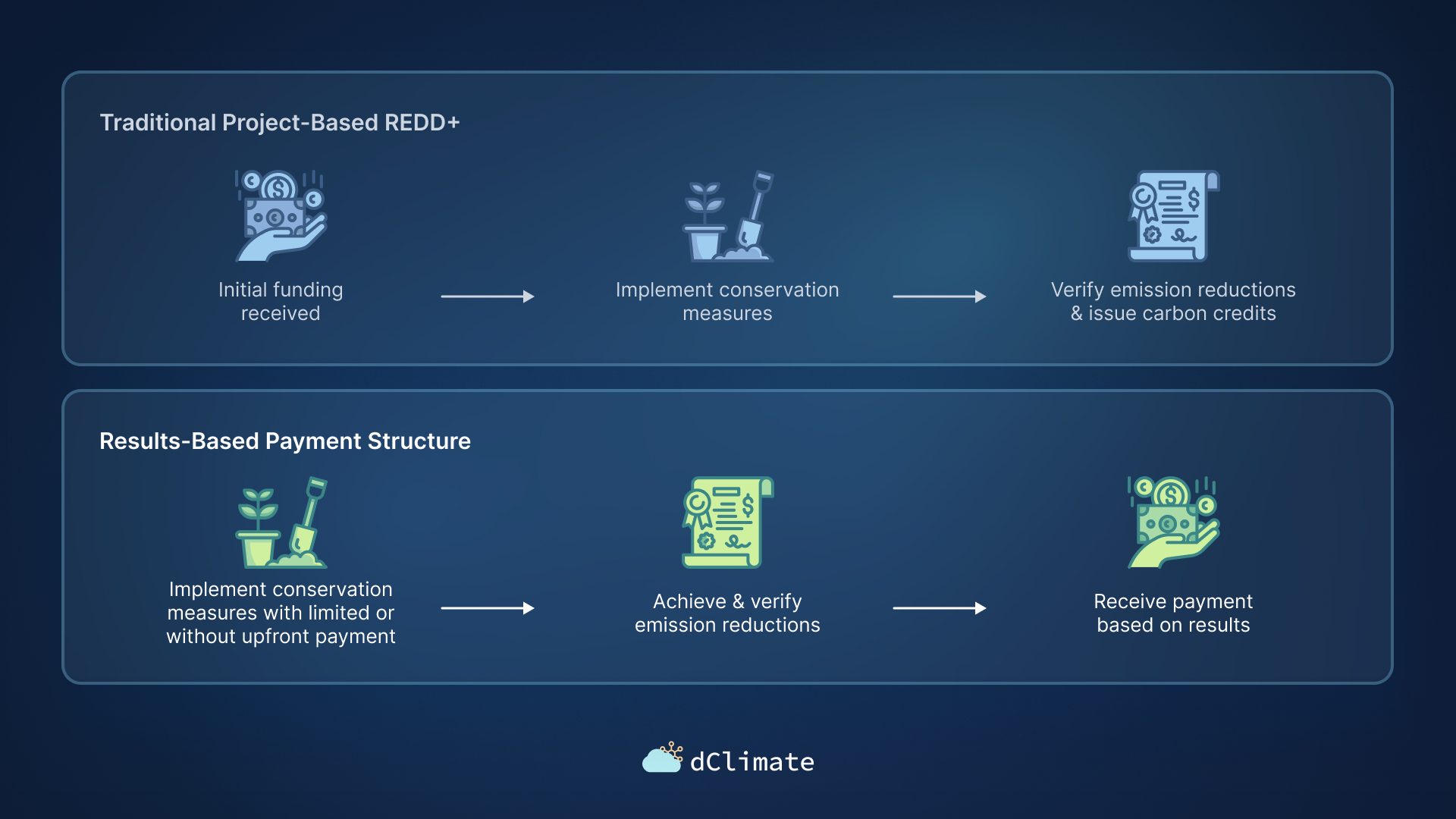

To date, nearly all J-REDD+ projects, if not every single one, have been established at the national level through specific, sovereign-led programs. The financing mechanism often involves a pay-for-performance scheme also referred to as Results-Based Payments (“RbP”) mechanism, or Pay to Preserve scheme, where payments to the country responsible for the preservation efforts are made ex-post, based on verified emissions reductions and following a well established MRV framework within the relevant jurisdiction. This approach is different from project-based REDD+ initiatives where funds are needed from the onset. While different, J-REDD+/RbP schemes aim to align financial incentives with long-term environmental outcomes, encouraging countries to implement effective land management, conservation strategies, and foster positive impacts for local communities. Some J-REDD+ RbP or result-driven frameworks, allow countries generating emission reductions to sell these as carbon credits to buyers.

Project-based vs. RbP Schemes

Project-based REDD+ initiatives have primarily adopted a specific methodology, the Verified Carbon Standard (or VERRA), which, according to MSCI Carbon Markets, accounted for about 80% of all REDD+ credit issuances in the last three years. Although VERRA has also developed methodologies for J-REDD+ projects, the issuance of credits under these frameworks has encountered delays. Conversely, J-REDD+ projects and Results-Based Payments (RbP) programs are typically implemented through international frameworks such as ART-TREE (affiliated with the American Carbon Registry), the Forest Carbon Partnership Fund (facilitated by the World Bank), and the Green Climate Fund.

Benefits and Challenges of J-REDD+ Programs

In addition to contributing to limiting leakage, another key benefit of J-REDD+ programs is their potential to create more significant, lasting impacts compared to smaller-scale projects. By addressing the root causes of deforestation and degradation at a systemic level and with the government’s support J-REDD+ can lead to more sustainable land use practices, enhance biodiversity, and improve livelihoods for local communities. Additionally, these programs can strengthen governance and legal frameworks, increase transparency in land use management, and foster stakeholder engagement and collaboration.

However, implementing J-REDD+ projects also presents challenges. These include the complexity of coordinating actions across large areas and diverse stakeholders (including governmental and public entities), ensuring the equitable distribution of benefits, and, ironically, managing the risk of leakage. To address these challenges, J-REDD+ programs often incorporate comprehensive planning and stakeholder consultation processes and mechanisms for monitoring, reporting, and verification that are also (and often, if not always, required) tailored to the jurisdictional context.

Growing Momentum for J-REDD+ Programs

Despite facing significant challenges in finalizing Articles 6.4 and 6.2 of the Paris Agreement at the most recent COP28 in Dubai, several countries have firmly committed to fostering international cooperation through bilateral agreements under Article 6.2. In December 2023, a series of Memorandums of Understanding were signed, and bilateral agreements were concluded, illustrating a concerted effort to enhance international collaboration for the transfer of Internationally Transferred Mitigation Outcomes (ITMOs).

The period following COP28 has also highlighted ambitious J-REDD+ initiatives by countries such as Honduras, Belize, and Suriname. These nations have unveiled plans to market their sovereign carbon credits derived from J-REDD+ projects. Negotiations with potential buyers aim to secure significant premiums for these credits. This emerging trend signifies a growing recognition of the value and potential that J-REDD+ projects hold within the international carbon market, and more particularly sovereign carbon credits.

These recent announcements indicate that carbon credits from J-REDD+ national programs may command a significant premium over those from traditional single projects. This premium could be attributed to factors such as the limited availability of J-REDD+/sovereign credits, the extensive scale and impact of these programs (including transparent benefits-sharing mechanisms), and the involvement of reputable organizations in public-private partnerships, providing rigorous oversight (e.g., UNFCCC, World Bank, Coalition for Rainforest Nations, the Nature Conservancy). These elements contribute to ensuring the perceived high quality and integrity of the credits.

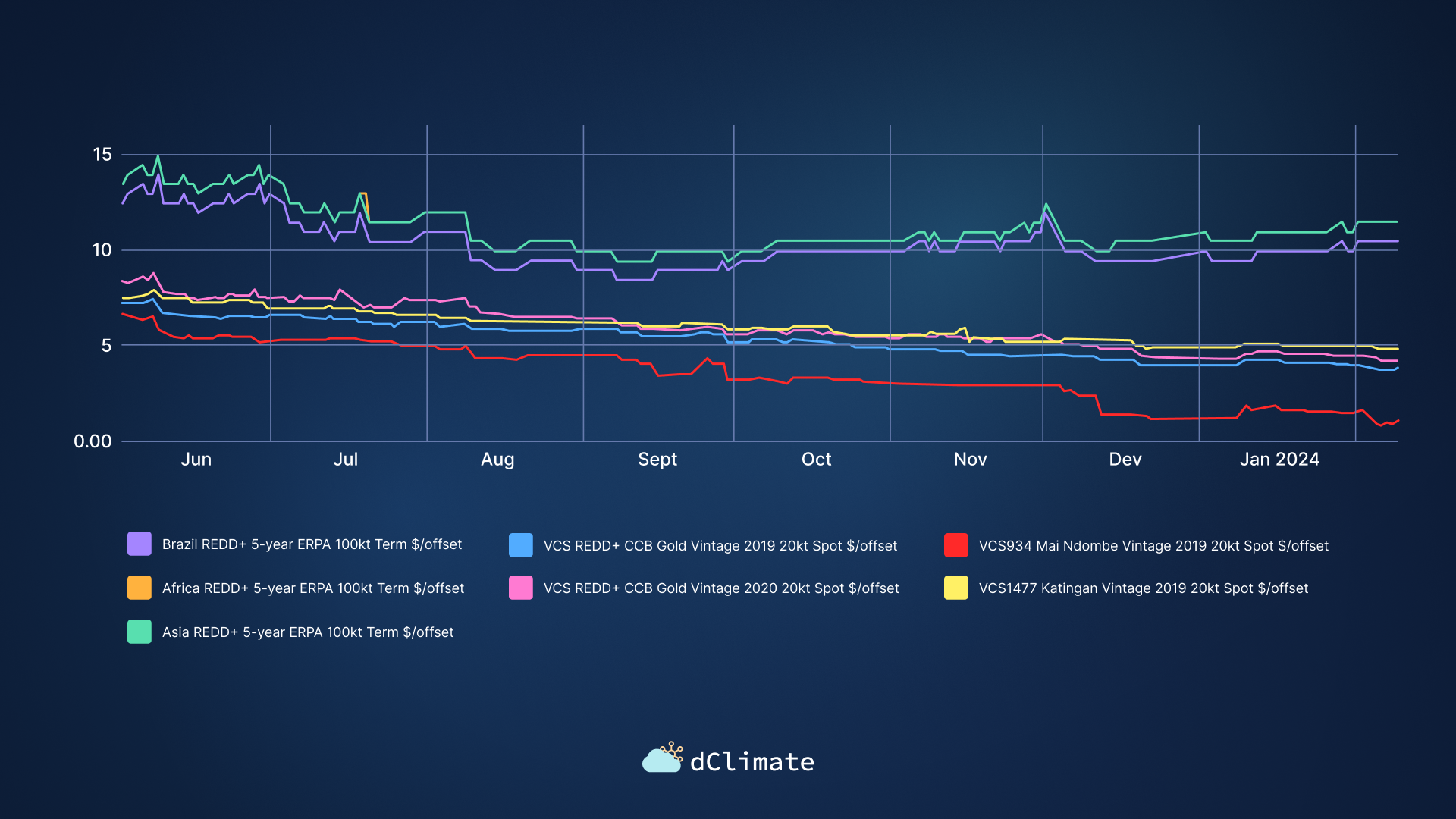

While it is still difficult to obtain price data on results-based payment programs, prices from REDD+ projects on the primary market command a higher premium than those from prices negotiated on the secondary market.

Comparison of REDD+ Projects - Primary vs. Secondary Prices June 2022-February 2024

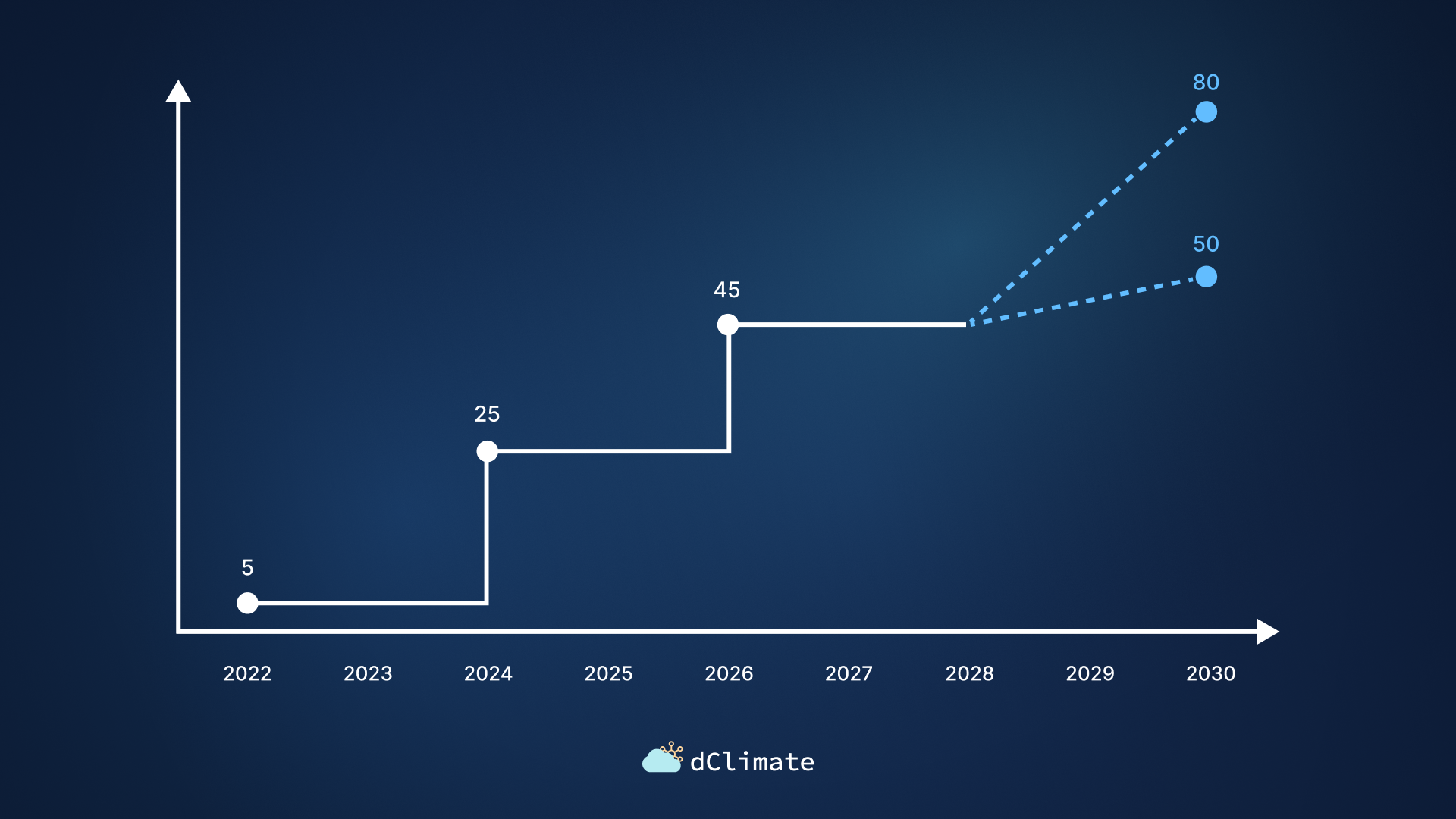

This increasing interest is evident in the supply of this type of sovereign carbon credits and their demand, as these credits may be used for compliance. The rise can be attributed to countries striving to achieve their NDCs, airlines seeking compliance with the UN's Carbon Offsetting and Reduction Scheme for International Aviation (“CORSIA”), or voluntary buyers requiring credits to meet various regulatory obligations, such as adherence to domestic carbon taxation schemes or emission allowance requirements. This confluence of factors is expected to drive a significant increase in demand for government-led REDD+ carbon credits, indicating a positive trajectory for the global effort to combat climate change through innovative and cooperative mechanisms.

Compliance Market Use Case: Singapore Carbon Tax Regime - S$ per ton

There Is More Than Meets The Eye

The landscape of forest conservation and its benefits to combat climate change is witnessing positive trends toward J-REDD+ programs and other RbP payments. These strategies highlight the evolving nature of the VCM towards a much-anticipated compliance market, and underscore a collective movement towards more systemic, impactful environmental stewardship at large.

The increasing interest and development in J-REDD+ programs and the strategic need for results-based payments represent a nuanced layer of global climate action efforts. Beyond the immediate benefits of reducing emissions from deforestation and forest degradation, these initiatives are carving pathways for enhanced biodiversity, community upliftment, and strengthening governance frameworks. The meticulous design and execution of such programs, underpinned by rigorous MRV systems (further enhanced by recent requirements for digital MRV), aim to ensure the integrity and effectiveness of each tonne of CO2e mitigated.

Innovative methodologies, like the recently updated introduced Verra J-REDD+ methodology (setting baseline at a jurisdiction level), supported by digital MRV systems that can provide jurisdictional level data/mapping and transparent monitoring throughout the lifecycle of a project, will ensure not only the integrity of credit issuance but help to build confidence amongst all stakeholders involved in these markets.

Moreover, the shift towards J-REDD+ and the potential premium on sovereign carbon credits in the international carbon market may indicate that market participants anticipate a final resolution under Articles 6.4 and 6.2 of the Paris Agreement.

As we look towards the future, the momentum around J-REDD+ programs and the burgeoning demand for high-integrity carbon credits suggests a promising avenue for advancing global climate goals. The journey from concept to implementation, and the challenges encountered along the way, illuminate the complexity and dynamism of this field. Yet, nations’, organizations’, and communities’ concerted efforts indicate a resilient, innovative approach to confronting climate change.

🌐 Check out our website, products, and blog

💽 Explore 40+ TB of free climate data via our data marketplace and API

📰 Sign up for our bi-weekly newsletter

🥳 Join the community: Twitter | LinkedIn | Discord | Telegram | YouTube