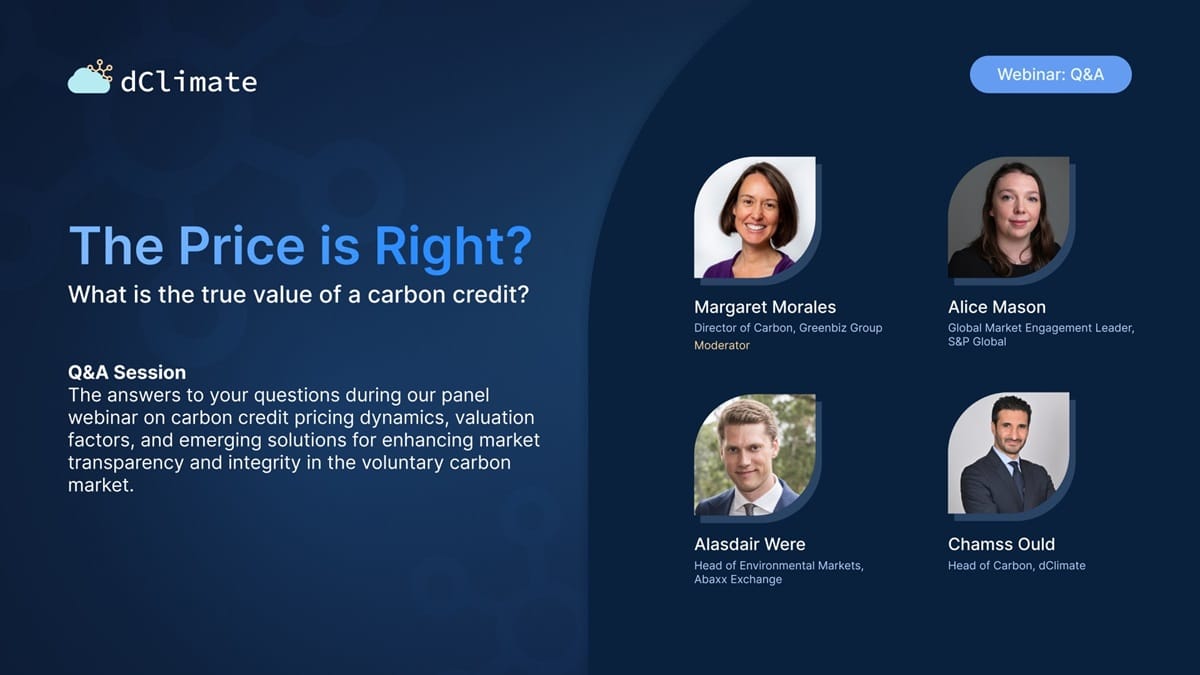

Webinar Q&A: What is the True Value of a Carbon Credit?

This blog post complements our July 18, 2024 webinar on price dynamics in the voluntary carbon market. During the panel discussion, we received more community questions than we could address live, so we've compiled all of them and provided answers in this write-up.

In case you missed the live session, you can view the recording below or on our YouTube channel.

Questions and Answers

Q: Keen to hear the panel's thoughts on REDD / REDD+ projects and their credibility. Have these improved at all since the infamous outing of them in 2022?

A: There has been a significant recognition of the need to improve these projects with standards adjusting their methodologies and market participants eager to provide solutions, like dMRV, to better quantify projects’ benchmarks.

From a supply/demand perspective, there is still demand for these projects due to the fact that they are heavily communities-centered and, unfortunately, still priced on the lower end. With that being said, credits from jurisdictional initiatives and other sovereign credits are priced at levels ranging from $15/t to $30/t.

Q: Following up on the discussion about pricing carbon credits, I'm curious about nature-based solutions for carbon removal. There's been development in blockchain-based registries offering future mitigated units (FMUs). Do you see any challenges in attracting buyers for these types of credits compared to traditional carbon offsets?

A: These new developments, while promising and can definitely help the market, still require market acceptance, in particular on the supply side (standards for example). With that being said, we know there is demand for on-chain registries and credits which dClimate is actively working on. It is also important to note that blockchain carbon efforts have focused on tokenizing carbon, which is a great next step for carbon markets, but currently, we need better infrastructure for onboarding and verifying supply - i.e., tokenization is the last step, not the first step.

Q: Sometimes, there is a disparity between the bids and the indexes for carbon credits since most are OTC. How can we close the gap?

A: This question has been answered in the panel discussion.

Q: I would love to hear the panel's thoughts on how project developers could set defensible long-term forward offtake pricing, e.g., 5+ years into the future, in the absence of such market data.

A: Despite limited data, price references are still available. What is missing are long-term price curves. That being said, some off-takers are willing to take on the risk, especially when the view is that prices are going to trend higher in 3, 5, or 10 years. As discussed during the panel, the project cost is known from the onset, which can be used as a floor price.

Q: Isn't the bond market the more appropriate asset class to compare carbon credits to?

A: They are comparable, and bonds have already been issued to finance carbon projects. However, we wouldn't say bonds are 'more appropriate'.

Q: If carbon is a commodity, how do we prevent pricing from falling into the same trap as other commodities, creating a race to the bottom with most of the margin taken by entities other than the local communities/landowners generating the carbon benefits?

A: This question was discussed in the live webinar.

Q: Corporations with good CSR policies, like MacLaren, have priced and paid $50 USD per nature-based solution carbon credit in South America, and a few other corporations likewise followed suit. Why are these outliers paid a fair price for a carbon credit compared to the rest?

A: There are several reasons why a corporate would pay higher prices:

- Perceived quality and whether it is removal vs. avoidance credits

- Additional co-benefits

- How much carbon is priced internally - in the case of Maclaren (and without diving into their strategy), the cost might be much higher than $50/t

- MacLaren's view of price outlook. If the expectation is that prices will be much higher when MacLaren needs to retire credits, it then makes sense to buy/invest today, even at a premium.

Q: Carbon aggregators are buying cheap futures/options credits from developers and selling higher to corporations. How to track these transactions for the sake of price discovery and transactions?

A: There are currently limited ways to track these transactions. This is why we believe the tools that were discussed during the panel (increased price transparency through platforms like S&P or Abaxx) and digital tools (like registries being developed by dClimate) are expected to better track transactions.

Q: From a project developer/seller point of view, what advantage is there is show the price on the market?

A: This question was answered in the panel discussion.

Q: What do you think about the payment of carbon reductions made by the World Bank to Ivory Coast for a price of $5, and how this can impact the VCM carbon pricing?

A: This payment is part of the World Bank Result-Based Payment scheme. The World Bank paid or will pay other countries. Unfortunately, the price has been set at around $5/t for all of these projects (forest preservation initiatives). This is certainly not enough. It does not seem to impact VCM carbon pricing much as these are limited in terms of volumes, and we’ve seen other similar/sovereign-led forest preservation initiatives being sold above $20/t.

Q: Given the discussion on the tradeoff fungibility vs. project-specific attributes, what needs do the panelists see in terms of contextual data on the ground to bring transparency and quality from ecological but social impact so the credits are not "washed out" and reduced to just a single number?

A: Great question! Digital MRV, new registries and higher project disclosures can help address this issue. Tracking, reporting and verifying projects’ benchmarks is paramount indeed so projects are not reduced to just a single number. Being able to quantify all the benefits, other than CO2 reductions, that these projects bring are a way to also give greater value when these credits are sold.

Q: I think there is an argument to be had that carbon is not a commodity. The reason is that most of the risk of the credits is not transferred from supplier to buyer. This is different from, say, timber, where once it moves to the buyer, the transaction finalizes for the most part.

A: The panelists discussed this comment in the live webinar.

Q: I'd be interested to hear if the panel has seen examples of corporates buying carbon offset projects to guarantee the security of supply and the extent to which this is occurring.

A: Yes, there have been quite a few public announcements of large corporates committing to purchasing credits, including Microsoft and Google, just to name a few. For the time being, these long-term offtake agreements are reserved for a few companies that have clear net-zero targets and the financial means to take such long-term views.

Q: What is the hope for the carbon credit market in Africa, particularly in Nigeria?

A: Africa represents an important opportunity to develop NbS projects, including in Nigeria. We are positive about the outlook, as evidenced by the number of countries implementing carbon trading laws.

Thank you for all the questions!

We appreciate all the questions and engagement we received during this webinar and hope that you gained valuable insights from this blog post.

To stay updated on our upcoming webinars, subscribe to our newsletter and follow us on LinkedIn and Twitter.

🌐 Check out our website, products, and blog

💽 Explore 40+ TB of free climate data via our data marketplace and API

🥳 Join the community: Discord | Telegram | YouTube