How to Prepare for the 2025 Atlantic Hurricane Season | Data ReFined #56

⛅ Data ReFined is dClimate's biweekly newsletter, delivering insights at the intersection of climate risk management, the voluntary carbon market (VCM), and climate intelligence.

With hurricane season on the horizon, this edition brings together key updates on forecasts and the growing role of data-driven tools like parametric insurance for climate resilience.

Climate Risk Management

🛡️ NOAA Predicts Above-Normal 2025 Atlantic Hurricane Season

🛡️ The Benefits of Parametric-Based Hurricane Insurance

🛡️ Wind-Related Hurricane Losses Projected to Increase by 76%

🛡️ EY: What Climate Risk Means for Bank Credit Losses

Carbon Finance & Digital MRV

🌳 How to Increase Carbon Credit Quality and Price

🌳 The New Floor Price for REDD+ Carbon Credits

🌳 Comparing High-Integrity Forest Carbon Projects Across Continents

🌳 The State of CORSIA Carbon Credits

Climate Data & Intelligence

🌎 How AI Is Shaping the Future of Weather Forecasting

🌎 What is the Most Accurate Hurricane Forecasting Model in 2025?

🌎 Open Climate Data from MeteoSwiss

Scroll down for more details! 👇

Subscribe here and join over 4500+ readers!

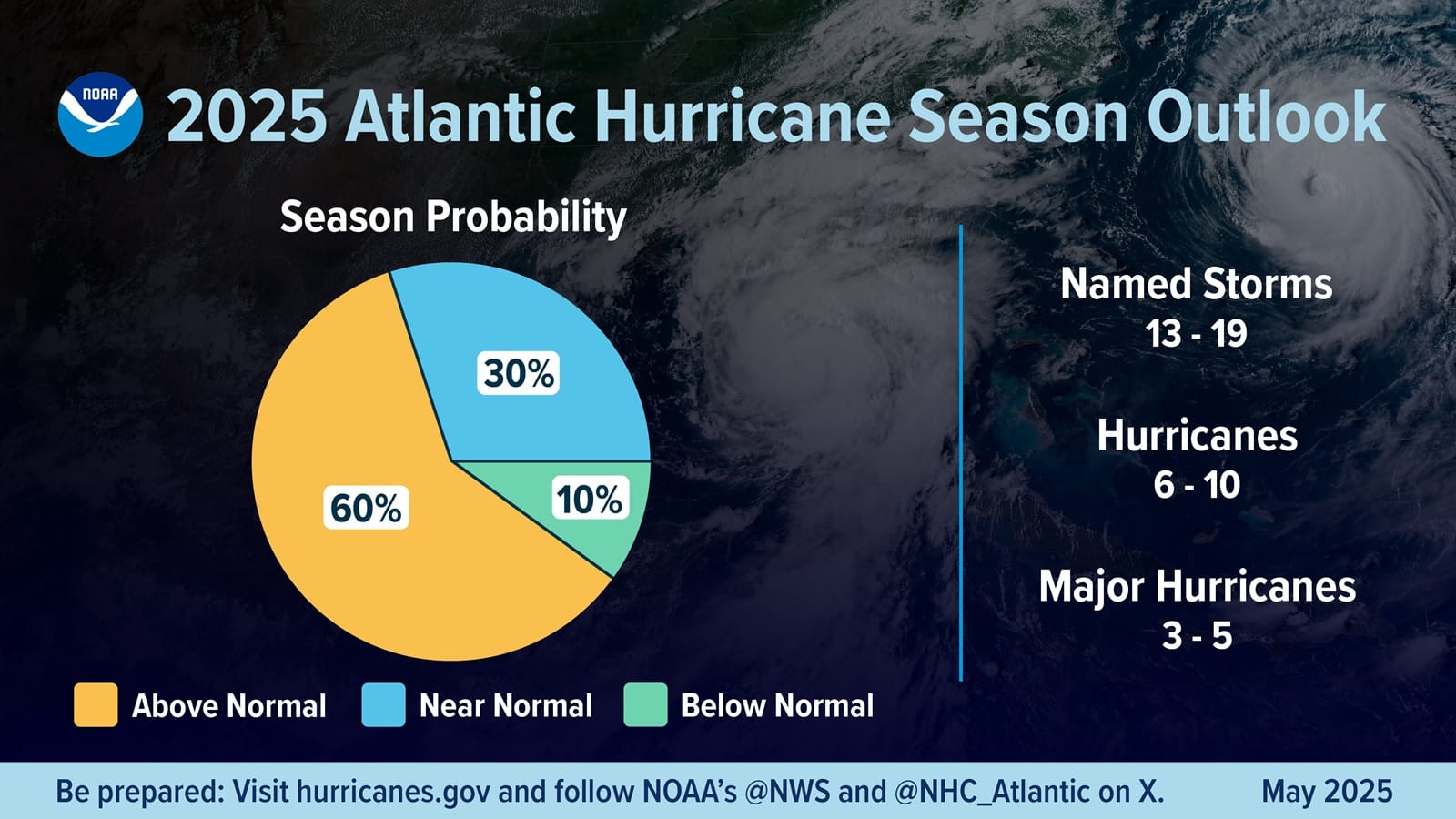

NOAA Predicts Above-Normal 2025 Atlantic Hurricane Season

With the official hurricane season running from June 1 to November 30, NOAA highlights that hurricane impacts can extend far inland, as seen with significant flooding from past storms.

Why this matters: Recognizing the broad reach of hurricanes ensures comprehensive emergency planning beyond coastal areas.

The Benefits of Parametric-Based Hurricane Insurance

Even weaker hurricanes now pose significant flood threats, with rising sea levels enabling Category 2 storms to drive floodwaters several miles inland. Arbol discusses how parametric insurance can address these evolving risks with clear triggers and rapid payouts. Read more →

Wind-Related Hurricane Losses Projected to Increase by 76%

A new study projects that wind-related hurricane losses for homeowners in the southeastern US could increase by nearly 76% by 2060 under a high-emissions scenario. The researchers used machine learning to simulate future impacts on homes across eight coastal states. Read more →

EY: What Climate Risk Means for Bank Credit Losses

EY's latest analysis reveals that integrating climate risk into IFRS Expected Credit Loss (ECL) models is becoming essential for banks, especially in sectors such as Oil & Gas, Power, and Automotive. The study emphasizes the need for improved internal climate risk models to accurately assess potential credit losses. Read more →

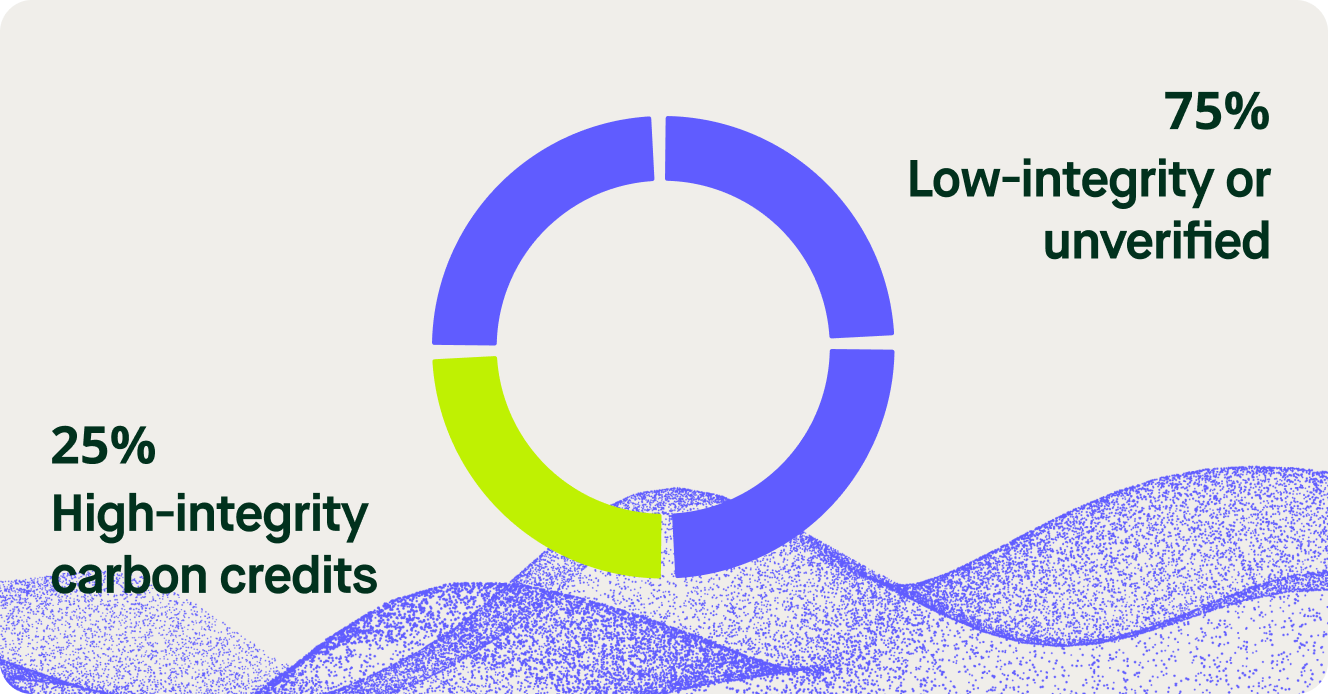

How to Increase Carbon Credit Quality and Price

In this guide, Sylvera outlines key ways to enhance the quality—and value—of carbon credits by addressing gaps in integrity, transparency, and data. Pre-Issuance Ratings give developers early feedback to improve the market value of carbon credits.

Why this matters: Stronger project fundamentals lead to better market performance and long-term credibility.

The New Floor Price for REDD+ Carbon Credits

Verra's new VM0048 methodology introduces stricter standards for REDD+ projects. To test this methodology, Abatable modeled a 50,000-hectare REDD+ project in Pará, Brazil. The analysis concluded that, under current market conditions, achieving a return on investment is unlikely without credit prices exceeding $15. Read more →

Comparing High-Integrity Forest Carbon Projects Across Continents

In this joint webinar, Arbonics and the American Forest Foundation explore the differences in forest carbon projects between the US and EU, focusing on landownership models, long-term carbon storage, and social equity. Read more →

The State of CORSIA Carbon Credits

MSCI forecasts that CORSIA carbon credit prices could rise from $18 to $51 per tonne in Phase I (2024–2026) to $27 to $91 per tonne by Phase II (2027–2035). This upward trend reflects increasing demand and the need for high-quality, verifiable carbon offsets. Read more →

How AI Is Shaping the Future of Weather Forecasting

Forecasting accuracy has steadily improved, yet challenges remain—especially for hyper-local storms and tropical rainfall. AI models now complement traditional physics-based methods by extracting more from observational data and generating higher-resolution forecasts with less computing power.

Why this matters: Improving forecast precision is crucial for climate-sensitive sectors such as agriculture, energy, and outdoor events, thereby helping to build resilience in a changing world.

What is the Most Accurate Hurricane Forecasting Model in 2025?

With a growing array of hurricane forecast models, including two new operational ones in 2024, determining which to trust can be challenging. This guide from Yale Climate Connections highlights which models lead the pack and why ensemble analysis remains the standard. Read more →

Open Climate Data from MeteoSwiss

MeteoSwiss has made its weather and climate records dating back to 1864 freely available, offering an unprecedented historical perspective on climate trends. Read more →

Thank You For Reading Our Newsletter! 💙

We greatly appreciate your interest and support! If you enjoyed this newsletter, please consider forwarding it to your network to increase awareness of these critical climate topics.

About dClimate

dClimate’s decentralized and open climate data infrastructure powers a wide range of solutions, including climate risk assessments, parametric insurance, and climate intelligence platforms for carbon and commodity markets.

⛅ Visit our website | 📊 Discover our climate tech solutions

Join the Mission

We welcome your comments, feedback, and likes. Follow us on the channels below to stay updated and start exploring our open climate data ecosystem. 👇