Decoding REDD+ Prices: Country Risk, Project Quality, and Credits Surplus

In light of recent market shifts and intensified scrutiny around Reduced Emissions from Deforestation and Degradation (REDD+) projects, carbon credit prices collapsed in early 2023 and remained constrained ever since.

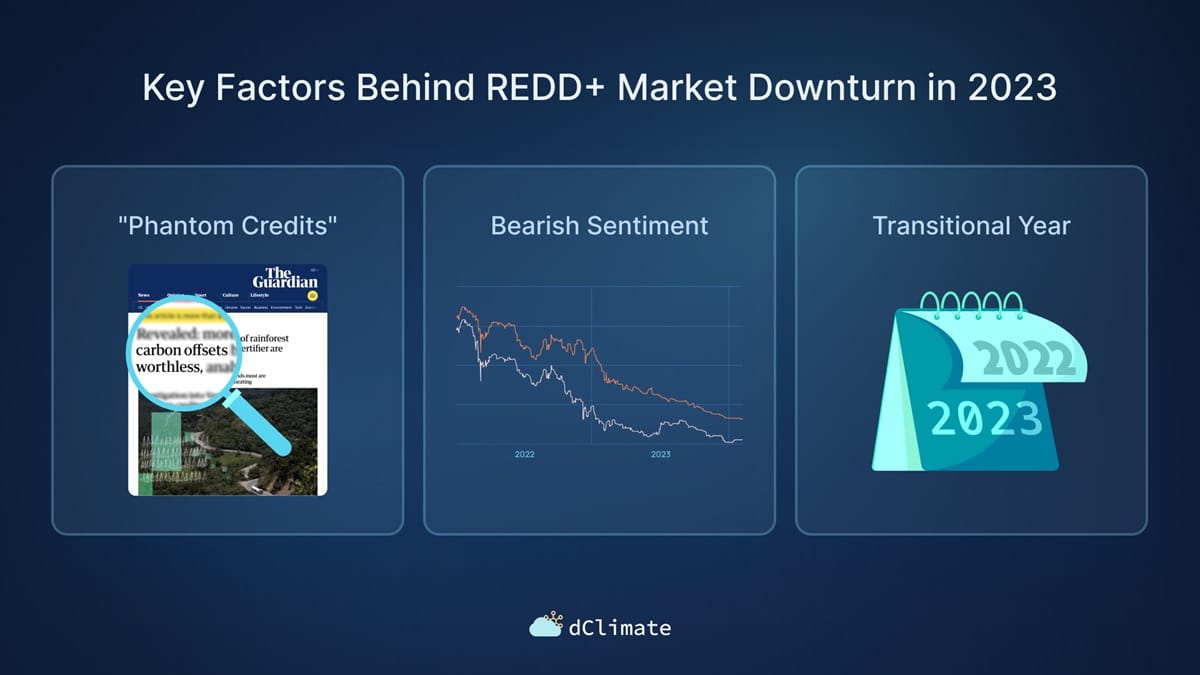

Multiple factors have contributed to this downturn:

- A highly publicized Guardian article (January 2023) labeling certain REDD+ credits as “phantom.”

- A broader bearish sentiment toward the Voluntary Carbon Market (VCM).

- The sense that 2023 was a transitional year for the VCM—marked by updated methodologies, new market entrants, and unresolved Paris Agreement Article 6 discussions.

Analyzing REDD+ Credits

While numerous elements influence carbon credit pricing—such as project type, location, additional certifications, compliance eligibility, and quality ratings—REDD+ credits, in particular, involve significant subjectivity. Their credibility often hinges on stringent monitoring and reporting tools, local land-use policies, effective enforcement, a clear and transparent benefit-sharing mechanism involving directly impacted communities, and sustained conservation efforts. Consequently, government involvement becomes a critical factor: stable policy frameworks and consistent oversight can bolster project integrity, while weak governance can heighten risks. Therefore, incorporating country ratings into REDD+ credit price analysis is essential, as they reflect the broader political and economic stability that supports the long-term success of these initiatives.

By evaluating each project’s location, country rating (indicating the risk of doing business in that country), BeZero’s project-level rating (reflecting the likelihood of emissions removal or avoidance), and credit surplus, a correlation between perceived national risk and project characteristics is observed. This relationship may contribute to the observed price differentials.

Surplus levels (i.e., the proportion of total issued credits not yet retired) further reflect market sentiment and demand: projects with high surpluses often struggle to attract buyers at premium prices. BeZero Carbon Ratings add another layer of insight by assessing a project’s quality, additionality, and risk of non-delivery. Taken together, these indicators—country ratings, surplus data, and independent rating frameworks—paint a nuanced picture of REDD+ credit valuation and underscore the multifaceted nature of today’s carbon market - without using additional labels, certifications or eligibility frameworks such as ICVCM’s CCP or CORSIA.

To analyze these dynamics, we have considered the following parameters:

Country Ratings (S&P, Moody’s)

Indicators of macroeconomic stability and policy reliability.

- Investment Grade: BBB-/Baa3 or higher, indicating lower sovereign risk.

- Sub-Investment Grade: Below BBB-/Baa3, reflecting higher risks such as policy volatility of a high risk of expropriation.

BeZero Carbon Ratings (BCR)

BeZero ratings evaluate the likelihood that one tonne of CO2e is genuinely avoided or removed, using a comprehensive project-level assessment (including a country analysis). Ratings range from AAA (highest likelihood of achieving carbon removal or avoidance) to D (lowest likelihood).

Price Categories

Projects are categorized into four tiers (Very High, High, Medium, Low) based on relative pricing, focusing exclusively on REDD+ credits. (Actual prices were omitted for confidentiality purposes.)

Credits Surplus

The difference between total issued credits and retired credits to date, illustrating supply-demand dynamics. High surplus often correlates with lower prices, while low surplus can signal scarcity and stronger demand.

This approach allows for a nuanced view of REDD+ credit pricing by considering supply fundamentals, country context, and project-specific quality.

Key Observations and Metrics

Correlation Between Surplus and Price Category

- Projects with low credit surpluses, such as Tambopata (21%) and Rimba Raya (25%), sit in the “Very High” price category, benefiting from perceived scarcity.

- Conversely, high-surplus projects like Southern Cardamom (77%) typically appear in lower price categories, reflecting weaker demand as well as ongoing issues at the project level.

Surplus levels significantly influence pricing; low surpluses command higher premiums due to market perception of limited supply.

The Importance of Country Ratings

- Projects located in investment-grade countries, such as Indonesia (rated BBB by S&P), frequently secure higher valuations (e.g., Rimba Raya, Katingan).

- In sub-investment-grade environments (e.g., Cambodia (rated B2 by S&P), DRC (rated B- by S&P)), projects like Southern Cardamom and Mai Ndombe often land in lower price tiers.

Country ratings provide a macro-level risk perspective, shaping buyer confidence in the regulatory and economic stability underpinning a REDD+ project.

BeZero Ratings and Carbon Reduction Likelihood

- Katingan (Indonesia, rated A by BeZero) exemplifies robust methodology and additionality, correlating with higher pricing and stronger buyer interest.

- Southern Cardamom (Cambodia, rated C by BeZero) illustrates how governance and baseline accuracy issues, compounded by external factors like Verra suspensions, can undermine credibility and depress prices. Key Insight: BeZero’s focus on carbon efficacy spotlights projects with solid fundamentals. A strong rating by BeZero often seems to be attracting premium buyers, even in riskier jurisdictions.

Local and Strategic Preferences

- Kasigau Phase II (Kenya) holds Medium pricing despite a 59% surplus, benefiting from strong local branding and alignment with community-focused objectives.

- Southern Cardamom (Cambodia) struggles, as governance and efficacy concerns deter buyers, reflecting a high surplus (77%) and a lower pricing tier.

Local relationships and strategic alignment can maintain moderate interest, but robust governance and transparent methodologies are still essential for premium valuations.

Conclusion

This analysis suggests a clear correlation between country ratings, project-specific quality (as measured by BeZero ratings), and credit surplus in determining REDD+ price categories. Projects with lower surpluses and higher ratings (both country and BeZero) tend to command higher prices, while those with higher surpluses and lower ratings generally see reduced buyer interest. These observations should be viewed as indicative rather than definitive, reflecting patterns in current market behavior rather than fixed rules for the future.

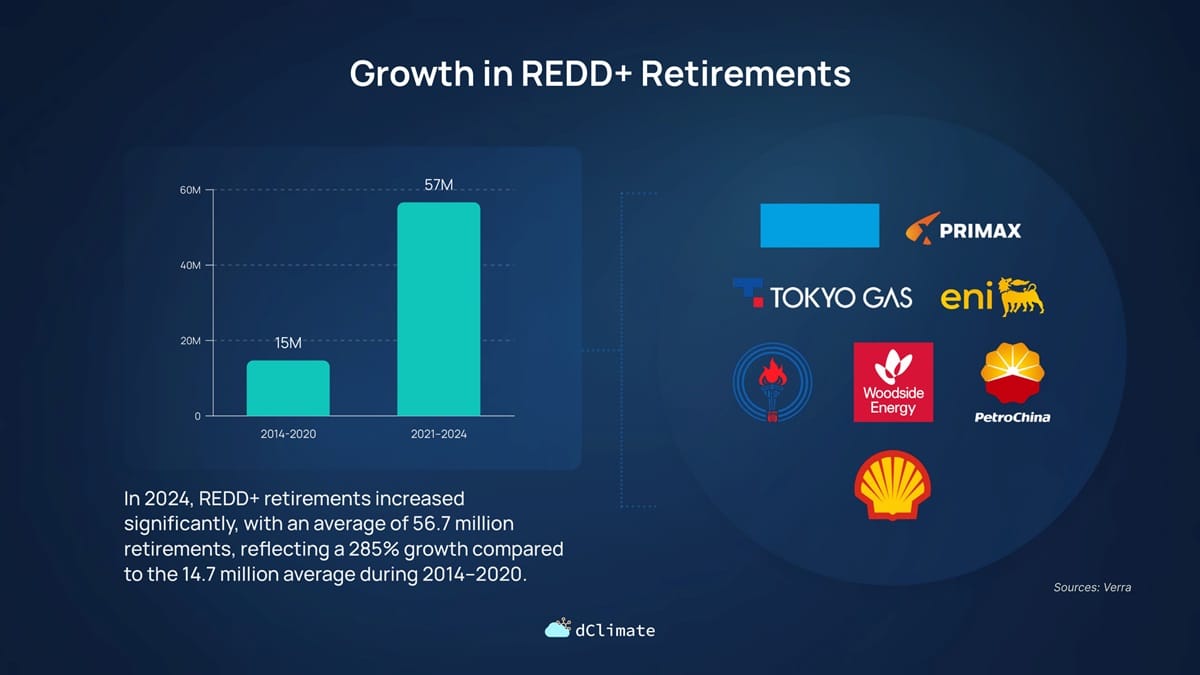

Buyer Trends in 2023–2024 further illustrate the evolving dynamics of REDD+ demand:

- In 2023, a notable price correction spurred bulk purchases from companies like Shell and PetroChina, capitalizing on lower prices.

- By 2024, new entrants such as Engie joined the market. Their strategies, whether cost-focused or driven by quality considerations, remain to be fully clarified.

Ultimately, while the actual impact of projects can influence companies’ decisions to buy offsets, pricing remains a critical driver. This is evidenced by the dramatic growth in REDD+ retirements: between 2014 and 2020, an average of 14.7 million REDD+ credits were retired annually. From 2021 to 2024, this number increased nearly fourfold, averaging 56.7 million credits annually.

Major contributors to this trend include companies like Shell, which retired over 29 million REDD+ credits from 2020 to 2024 YTD, and Eni, which retired nearly 12 million credits over the same period.

While supply-demand dynamics, country risk, and project quality remain pivotal, pricing continues to be the dominant driver in REDD+ market trends. These factors underscore the need for ongoing analysis to better understand the interplay of governance, transparency, and demand in shaping the future of the REDD+ market.

About dClimate

dClimate’s decentralized and open climate data infrastructure powers a wide range of applications, such as climate risk solutions, parametric insurance, and climate intelligence platforms for carbon and commodity markets.

⛅ Visit our website | 📊 Discover our products

Join the dClimate Community!

We welcome your comments, feedback, and likes. Follow us on the channels below to stay updated and start building in our decentralized climate data ecosystem. 👇