dClimate Launches Tyche: Programmable Infrastructure for Insurance & Reinsurance Markets

For decades, insurance and reinsurance markets have been constrained by a simple reality: portfolios are complex, dynamic, and highly specific, while the instruments used to manage them are standardized, static, and defined upstream by exchanges or intermediaries. Institutions are forced to hedge real exposure using proxy products that only partially fit, accepting basis risk and inefficiency as unavoidable.

This model persists not because it works well, but because it is the only market structure available.

Today, dClimate is announcing Tyche, a programmable platform designed to change that structure. Tyche modernizes how insurance, reinsurance, and insurance-linked exposure is structured, funded, and traded by starting with the portfolio itself. Instead of forcing portfolios to conform to pre-defined contracts, Tyche enables portfolio-specific exposure to be isolated, modeled, and transformed into bespoke financial products that can be directly matched with capital seeking yield and uncorrelated returns.

This is not a theoretical system. During the most recent hurricane season, Tyche originated and placed $20 million of live notional exposure, demonstrating that portfolio-native products can be structured and funded dynamically under real market conditions.

Why Insurance & Reinsurance Markets Need a New Primitive

Insurance and reinsurance participants face a persistent structural mismatch. Real portfolios are granular, localized, and constantly evolving, while most transfer mechanisms remain broad, static, and standardized. Institutions hedge using instruments that only loosely resemble their actual exposure, creating hidden fragility across portfolios.

The result is a market where capital is misallocated, pricing signals are diluted, and portfolios that appear protected on paper remain exposed in practice. At the same time, investors face limited access to well-defined structured opportunities and little ability to actively manage positions once capital is deployed.

Tyche is designed to invert this model by replacing exchange-defined products with portfolio-defined product creation.

From SaaS Tools to Portfolio Agents

dClimate’s platform is built around three core agents from the dClimate Labs product suite—Siren, CYCLOPS, and Aegis—each designed to work directly on a specific type of portfolio and output a specific class of financial product.

These agents are not dashboards, benchmarks, or generic analytics layers. Each ingests proprietary data, analyzes portfolio-specific dynamics, and produces a product definition tailored to the underlying portfolio.

This architectural shift moves dClimate beyond traditional “climate SaaS” and squarely into market infrastructure.

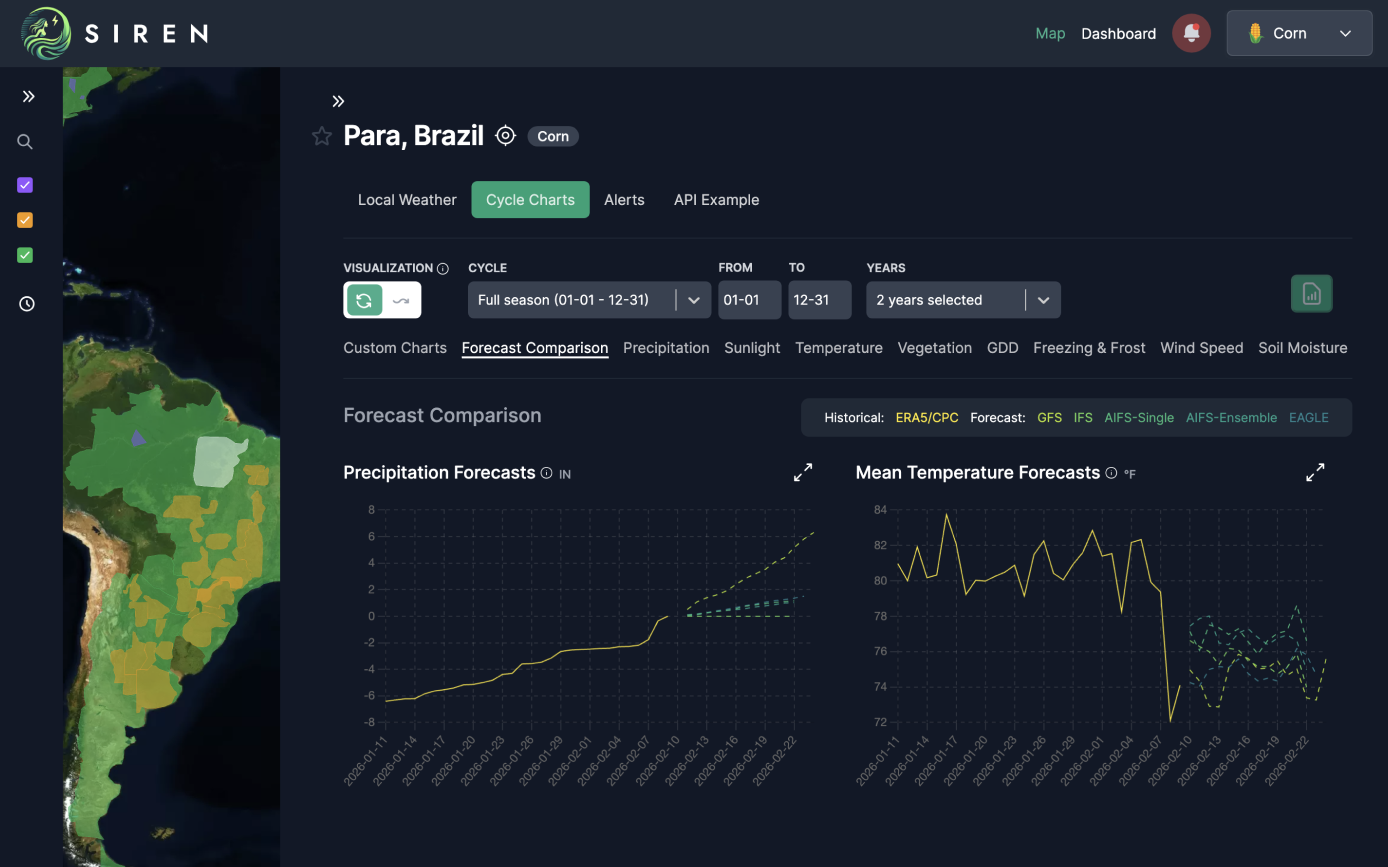

Siren: Structuring Derivatives from Operating Portfolios

Siren is deployed to energy, agriculture, and commodity-driven businesses. It works directly with operational and exposure data to understand how portfolio dynamics behave over time. Rather than mapping those dynamics to pre-existing instruments, Siren isolates the relevant drivers and helps structure bespoke derivatives aligned to the portfolio itself.

The result is materially lower basis risk. Products are defined by what the portfolio actually experiences, not by what happens to exist on an exchange.

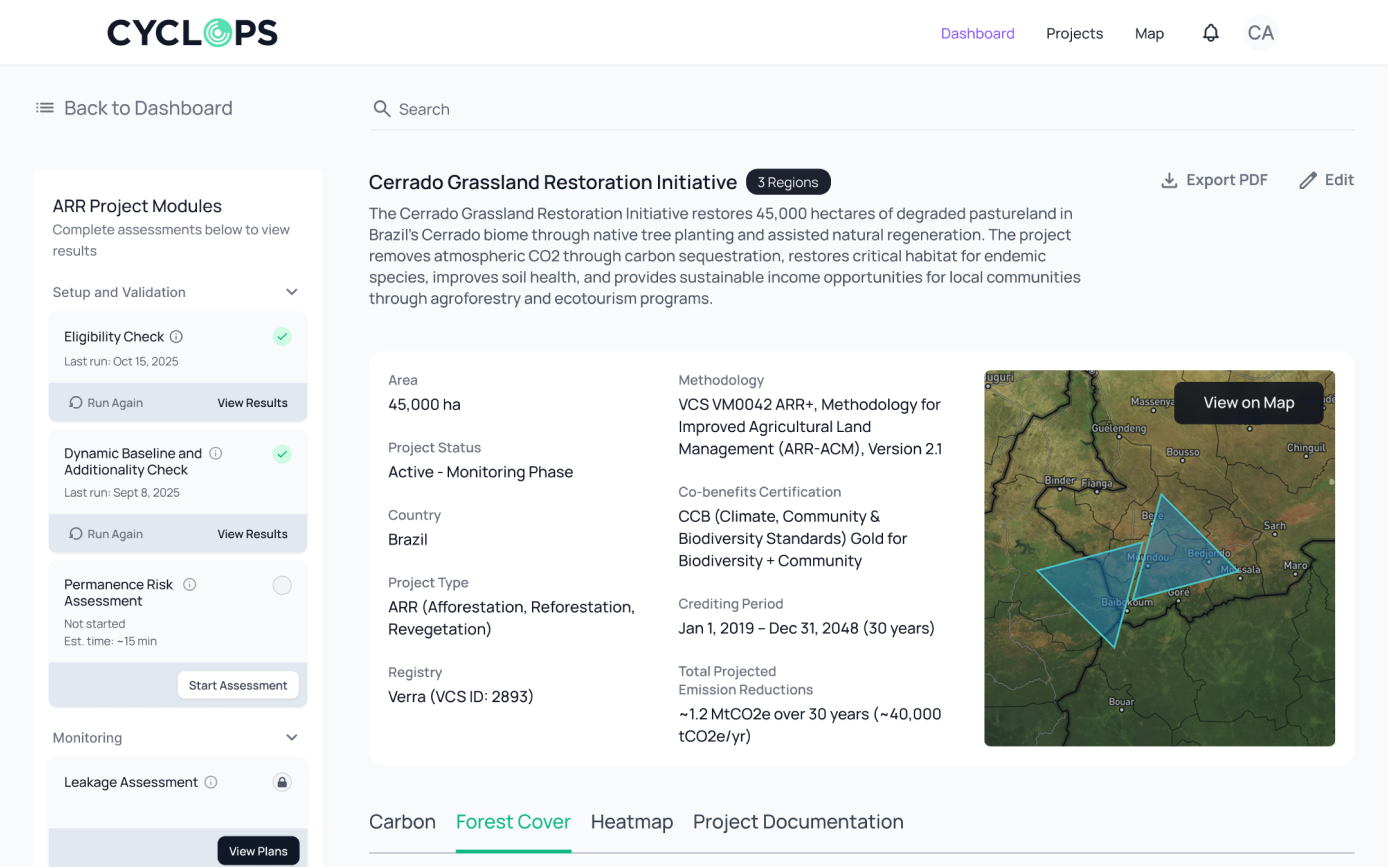

CYCLOPS: Structuring Credits from Projects

CYCLOPS is deployed to project developers and asset owners. It analyzes individual projects and portfolios of projects to understand performance, outcomes, and eligibility characteristics. From that analysis, CYCLOPS helps structure the appropriate credits tied directly to those assets.

Rather than forcing projects into rigid categories, CYCLOPS enables credits to be defined by observed characteristics and modeled outcomes at the project level—allowing capital to be deployed with greater precision and confidence.

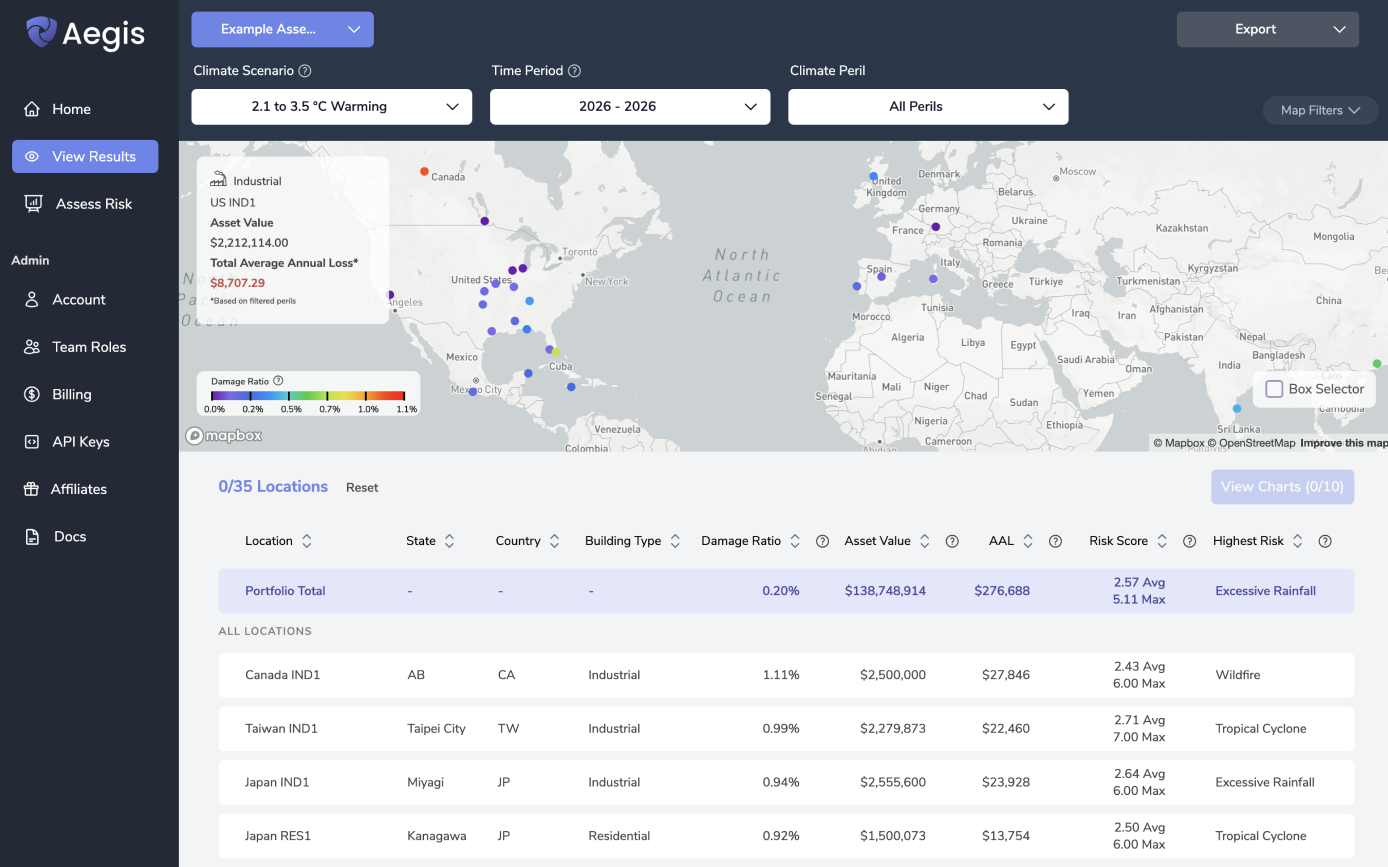

Aegis: Structuring Portfolio Risk Products for Insurers

Aegis is deployed to insurers and risk-bearing institutions. It works directly on insurance portfolios to identify how exposure aggregates, where concentrations emerge, and how portfolio behavior evolves over time. From that analysis, Aegis helps structure portfolio-level risk-transfer products, including bond-like instruments designed around the insurer’s actual book.

Aegis is not a reporting tool or a benchmarking system. It is a portfolio analysis agent whose output is a new product, purpose-built for that portfolio rather than selected from a predefined universe.

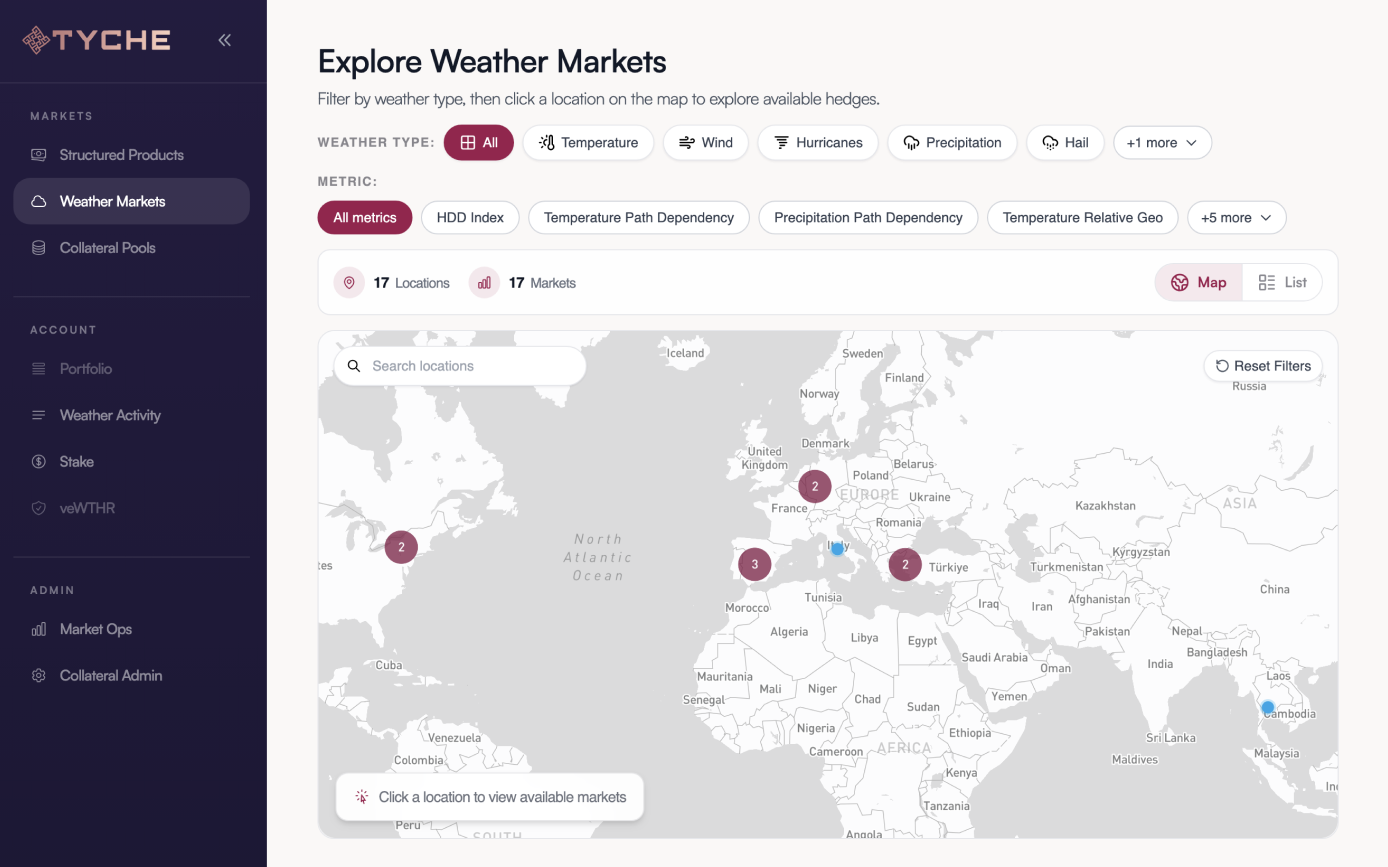

Tyche: Where Products Become Markets

Tyche is the execution and funding layer where products structured by Siren, CYCLOPS, and Aegis are originated, fractionalized, and transferred.

Once an agent defines a product, Tyche enables it to be issued in tokenized form, giving capital providers access to clearly defined exposures with transparent pricing and yield characteristics. Products can be funded directly, traded over time, and integrated into broader portfolios.

This architecture removes centralized product gatekeeping and replaces it with programmable product creation, where markets respond to portfolios rather than constraining them.

Who Tyche Is For

Tyche is designed for institutions operating at the intersection of portfolios and capital:

- Primary insurers seeking to isolate and transfer specific exposure within complex books

- Reinsurers managing concentration, aggregation, and dynamic portfolio behavior

- ILS funds and alternative capital providers looking for fractionalized, transparent, structured exposure

- Asset managers constructing diversified portfolios of uncorrelated risk

- Operating companies whose exposure cannot be cleanly hedged with standardized instruments

In each case, the common shift is the same: products are built around portfolios, not the other way around.

A New Model for Risk Markets

The significance of Tyche is not incremental efficiency—it is structural. By pairing portfolio-native agents with programmable market infrastructure, dClimate enables a shift away from proxy hedging and standardized contracts toward bespoke, data-driven financial products.

Future releases will extend this model further, introducing automated settlement, leverage facilities, pooled structures, and on-chain trading. Together, these capabilities move insurance and reinsurance markets toward the flexibility and composability expected in modern capital markets.