Data ReFined Decoded - What is a Dynamic Carbon Token?

Revolutionizing the Carbon Market with Data-Driven, Accountable, and Transparent Offsets

As climate change continues to shape the global agenda, there's a growing focus on the role of carbon markets and offsets in reducing greenhouse gas emissions. This has given rise to an innovative concept called Dynamic Carbon Tokens, a novel approach to carbon credits that leverages the latest advancements in technology and data-driven methodologies. In the first edition of Data ReFined Decoded, we explore Dynamic Carbon Tokens: what they are, how they work, and their potential to revolutionize the voluntary carbon market.

Understanding Carbon Offsets

Before diving into Dynamic Carbon Tokens, it's essential to understand the concept of carbon offsets. Carbon offsets are certificates or credits that represent the reduction or removal of greenhouse gas emissions equivalent to one metric ton of carbon dioxide (CO2). These offsets can be generated through various activities, such as renewable energy projects, reforestation efforts, and methane capture from landfills. Businesses and individuals can purchase these offsets to compensate for their emissions, effectively reducing their carbon footprint.

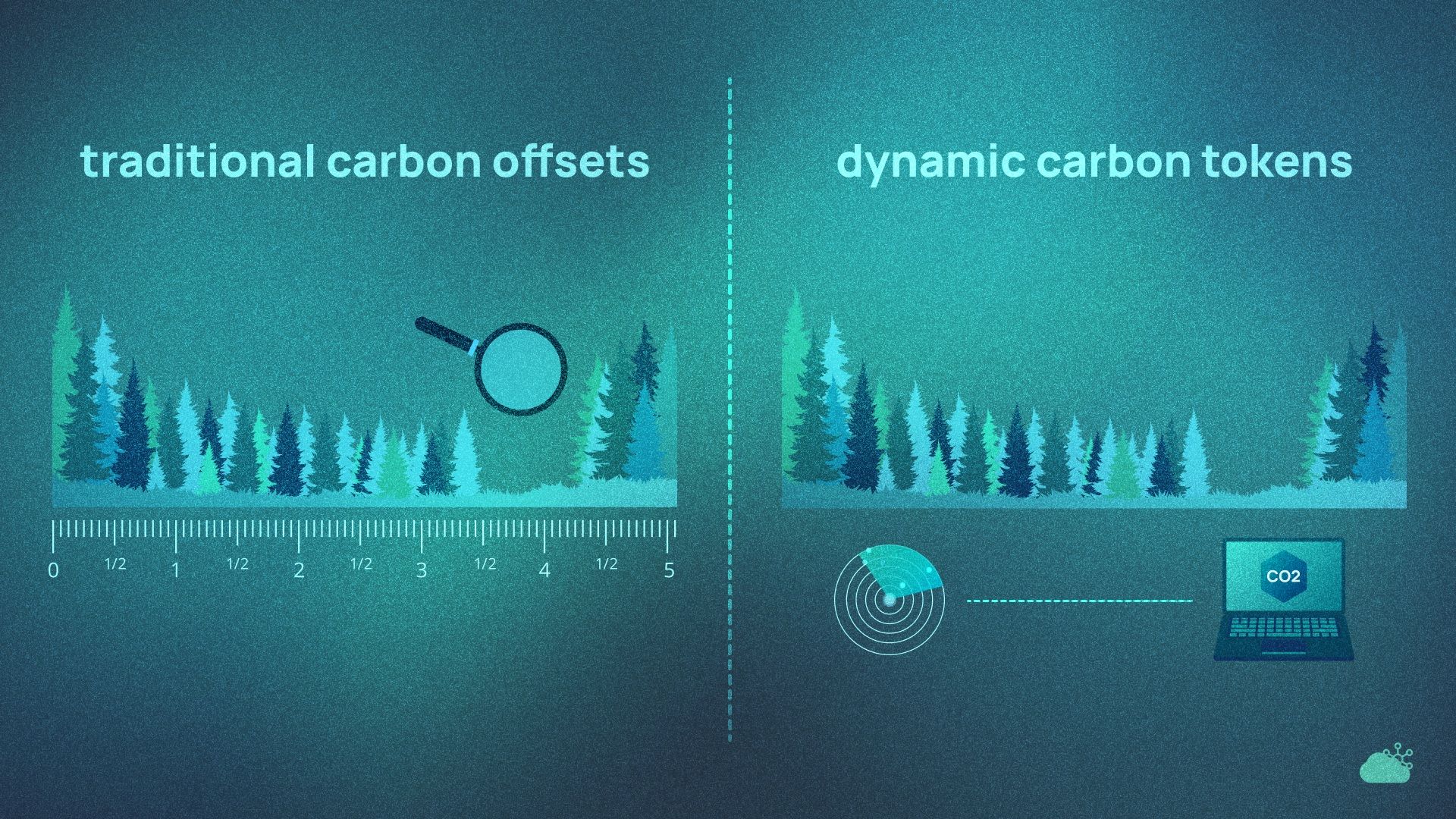

Traditional Carbon Credits: The Challenges

While carbon offsets have played a significant role in promoting climate-friendly projects, they have faced criticism due to issues surrounding their transparency, accountability, and accuracy. Carbon offset projects often require extensive monitoring, reporting, and verification (MRV) processes to ensure that the claimed emissions reductions are accurate and genuine. However, traditional MRV systems can be resource-intensive, expensive, and time-consuming, limiting the scalability and efficiency of the carbon market. We previously covered some of the limitations of traditional MRV and how digital MRV systems can revolutionize carbon markets in this blog post.

The Benefits of Tokenization

Tokenization is the process of converting an asset, in this case, carbon credits, into digital tokens on a blockchain platform. This approach enables several benefits for the carbon market:

- Transparency: Blockchain provides an immutable ledger that records all transactions related to the carbon tokens, ensuring a high level of transparency and traceability.

- Accountability: Tokenization allows for the unique identification of each carbon credit, making it easy to track the lifecycle of the credit and its environmental impact.

- Scalability: Digital tokens can be easily bought, sold, and traded on various platforms, fostering liquidity and encouraging participation in the carbon market.

- Lower costs: By streamlining the MRV process and automating transactions, tokenization can significantly reduce the costs associated with carbon credit management.

Introducing Dynamic Carbon Tokens

Dynamic Carbon Tokens take the concept of tokenized carbon credits a step further by incorporating dMRV (digital Monitoring, Reporting, and Verification) technology. dMRV is an innovative approach that leverages real-world data (satellite, geospatial, sensor data, etc.) and advanced analytics and algorithms to monitor and verify the emissions reductions associated with carbon offset projects continuously. This ensures that the value of the carbon credit remains accurate and up-to-date, reflecting the true ecological impact of the project.

By combining tokenization with dMRV technology, Dynamic Carbon Tokens can deliver several unique benefits:

- Enhanced accuracy: dMRV systems can detect changes in the ecosystem used to create the carbon offset vintage, dynamically updating the token's value to ensure it accurately represents the underlying ecological asset.

- Greater accountability: The real-time data provided by dMRV systems allows for improved oversight and more stringent verification processes, ensuring the integrity of the carbon market.

- Streamlined processes: The integration of dMRV technology with tokenized carbon credits can help automate and streamline the MRV process, reducing costs and improving efficiency.

One of the major challenges in the carbon market is fostering trust among corporates, governments, and individuals. This trust is crucial to ensuring that projects contribute to genuine, verifiable, and additional emissions reductions.

A recent Guardian article highlighted the issues with forest carbon offsets from the biggest provider, revealing that some credits were potentially worthless. The adoption of Dynamic Carbon Tokens can mitigate these trust issues by ensuring that carbon credits are accurately represented and continuously updated based on real-world data. The transparency and accountability provided by Dynamic Tokens not only safeguard the integrity of carbon offset projects but also reinforce confidence in the voluntary carbon market, encouraging wider participation from various stakeholders in the fight against climate change.

Case Study: Avoided Deforestation Project

Consider an avoided deforestation project in the Amazon Rainforest. A conservation organization works with local communities to protect a large area of the forest, preventing logging and agricultural activities that would have otherwise led to significant carbon emissions. To finance this project, the organization issues Dynamic Carbon Tokens, each representing a specific amount of carbon emissions avoided through the project's activities.

The dMRV system monitors various data points, such as satellite imagery, ground-based observations, and remote sensing technologies, to assess the health of the forest and determine the actual amount of carbon emissions avoided. This information is used to calculate the value of the Dynamic Carbon Tokens, ensuring that they accurately represent the project's environmental impact.

Suppose a large-scale fire occurs in a portion of the protected forest, releasing carbon dioxide into the atmosphere and reducing the project's overall carbon sequestration capacity. The dMRV system detects the changes in the forest's condition and dynamically adjusts the value of the Dynamic Carbon Tokens accordingly. This ensures that the tokens always reflect the true environmental impact of the avoided deforestation project.

When the affected area begins to recover and regrow, the dMRV system updates the token values once again, reflecting the improved carbon sequestration capacity of the project. This dynamic process ensures that the carbon market operates with transparency, accountability, and accuracy, fostering trust and confidence among participants. How does this work in practice? There are several actors involved in a carbon financing market structure, including project developers, verifiers, registries, etc.

Implementing a Dynamic Avoided Deforestation Project

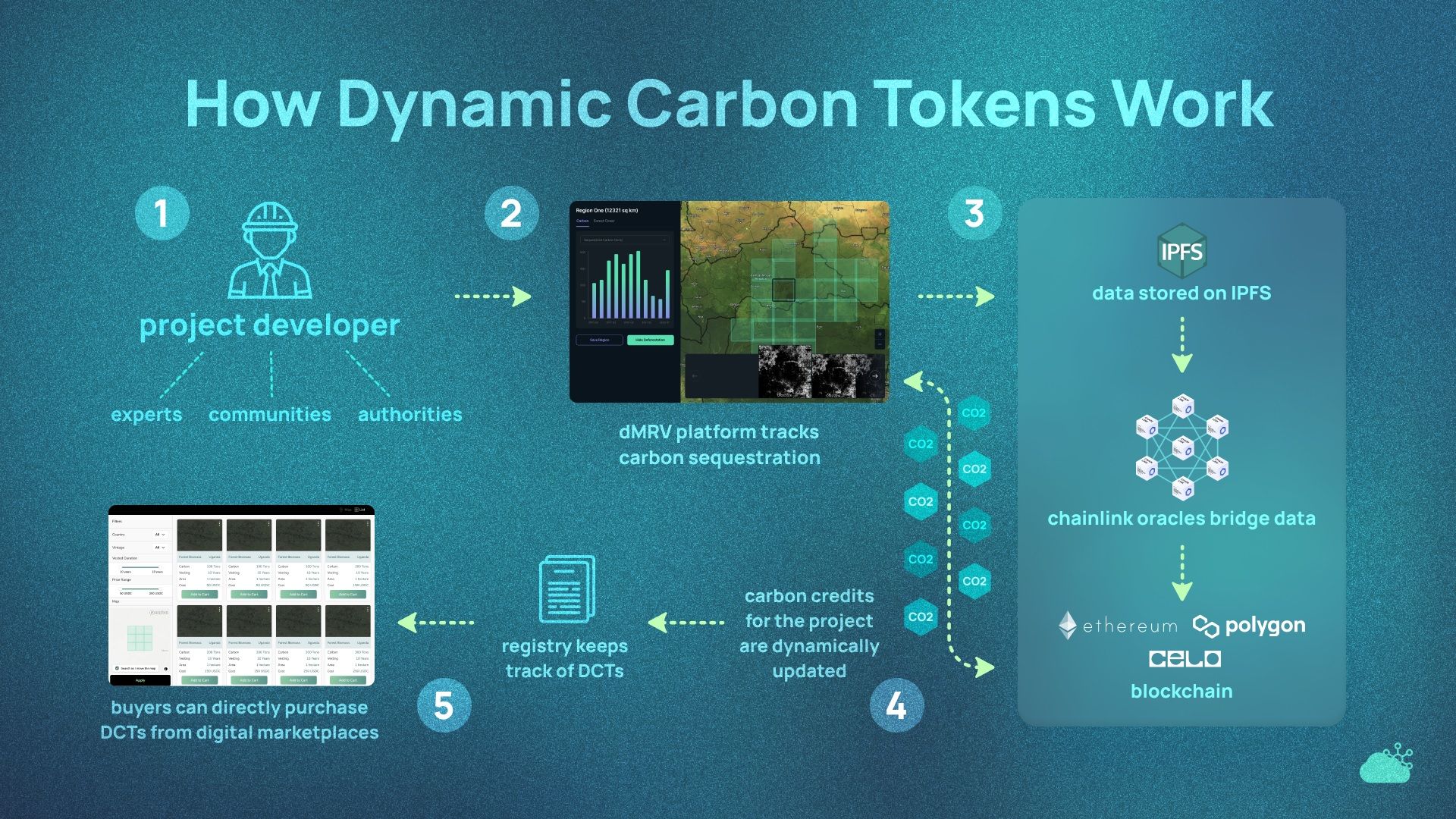

The project developer initiates the avoided deforestation project, committing to preserve a specific area of forest from logging activities. The developer works with local communities, authorities, and experts to establish baselines and monitor the progress of the project.

The dMRV platform is used to measure and track the carbon sequestration performance of the project. It collects data on variables such as tree growth, species composition, and carbon stocks, using advanced technologies like remote sensing and IoT devices.

The collected data is stored securely and transparently on a decentralized storage system like IPFS. This ensures the data's immutability, preventing tampering or manipulation, and enables real-time updates as new information is gathered from the dMRV platform.

Chainlink’s industry-standard decentralized oracle network can be utilized to connect the blockchain platform with the dMRV platform (blockchains need oracles to bring real world data on-chain), enabling seamless data transfer between the two systems. This ensures that the carbon credits generated by the project are accurately represented and dynamically updated based on real-world data.

A registry keeps track of the Dynamic Carbon Tokens, which represent the carbon credits generated by the project. These tokens are minted on a blockchain platform like Celo or Ethereum and linked to the project's performance data. The registry records the ownership, transfer, and retirement of the tokens, ensuring a transparent and traceable carbon market.

The carbon credits generated by the avoided deforestation project are tokenized as Dynamic Carbon Tokens. In the Ethereum ecosystem, these tokens would essentially be non fungible tokens (NFTs), following either the ERC-721 or ERC-1155 standard. These tokens can be traded, sold, or retired by buyers looking to offset their carbon emissions. The dynamic nature of the tokens ensures that the underlying ecological asset is accurately represented, fostering trust and confidence in the voluntary carbon market.

Dynamic Carbon Token Ecosystem

In this model, the various components work together to create a transparent, accountable, and efficient carbon market that promotes trust among stakeholders. The use of Dynamic Carbon Tokens, powered by cutting-edge technologies like dMRV and blockchain, ensures that the carbon credits generated by the avoided deforestation project contribute to real, verifiable, and additional emissions reductions.

Dynamic Carbon Tokens represent a significant step forward in the evolution of the carbon market, combining the benefits of tokenization with the power of dMRV technology to create a more transparent, accountable, and efficient system for managing carbon offsets. By ensuring that carbon credits are always accurate and up-to-date, Dynamic Carbon Tokens have the potential to drive greater participation and investment in climate-friendly projects, ultimately contributing to the global effort to combat climate change.

As the voluntary carbon market continues to grow and evolve, innovations like Dynamic Carbon Tokens will play a critical role in shaping its future. By embracing cutting-edge technology and data-driven methodologies, we can build a more sustainable, resilient, and green economy for generations to come.