Data ReFined #37: New Market Alliance For High-Quality Article 6 Carbon Credits

⛅ Data ReFined is dClimate's biweekly newsletter, delivering the latest insights on carbon finance in the voluntary carbon market (VCM), climate risk management, and climate data.

In this edition:

Carbon Finance & Digital MRV

🌳 What is the True Value of a Carbon Credit?

🌳 Singapore's New Market Alliance for High-Quality Carbon Credits

🌳 Colombia Reports 36% YoY Decrease in Deforestation

🌳 NFTs with Built-In Carbon Removal Credits

Climate Risk Management

🛡️ Climate Risk Assessments Shape Insurers’ Portfolios

🛡️ Enhancing Africa’s Climate Resilience with Parametric Insurance

🛡️ Robusta Coffee as Climate-Smart Alternative to Arabica

🛡️ First Street Secures $46M for Physical Climate Risk Modeling

Climate Data & Intelligence

🌎 Hurricane Beryl and AI-Driven Forecasts

🌎 Hybrid Climate Model Equips East Africa for Extreme Weather

🌎 Updated Dataset: Tropical Moist Forests (TMF)

Scroll down for our summaries of this news! 👇

Subscribe here and join over 4000+ readers!

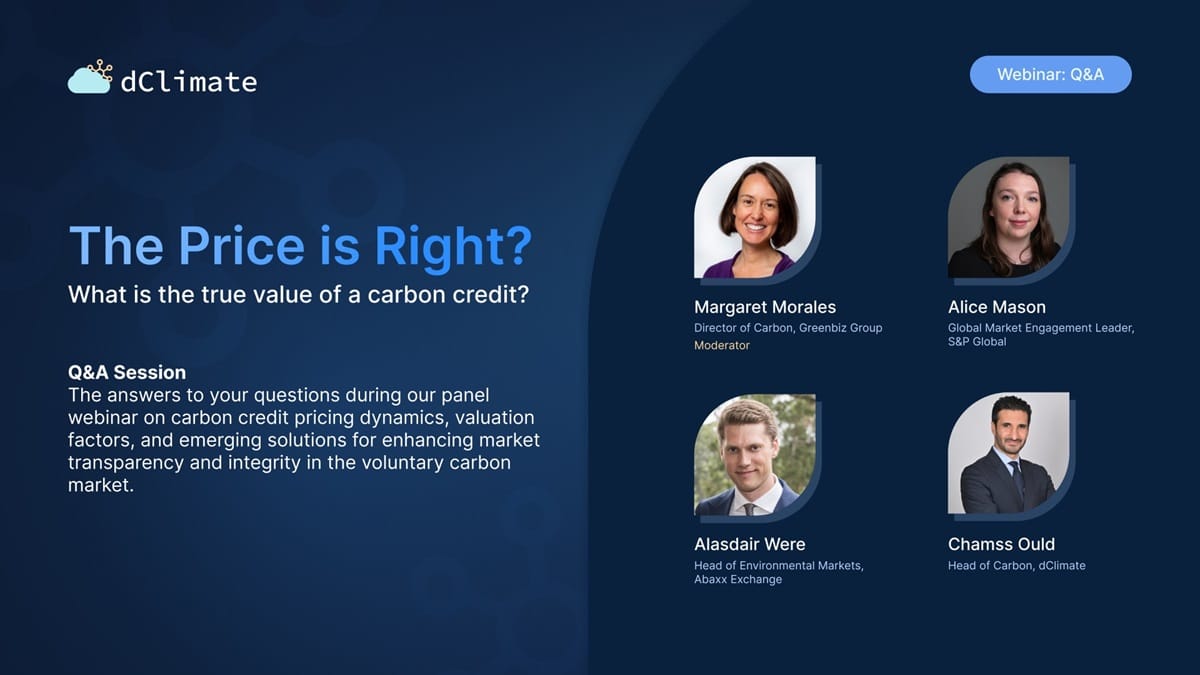

What is the True Value of a Carbon Credit?

Our recent webinar on voluntary carbon market pricing dynamics sparked many thoughtful questions from attendees. While we couldn't cover them all live, we've provided detailed answers to each one in our latest blog post.

New Market Alliance for High-Quality Carbon Credits

The Singapore Carbon Market Alliance (SCMA) has been established to facilitate the purchase of high-quality carbon credits under Article 6, while also educating companies on international carbon credit standards. By fostering a transparent and robust carbon market in Singapore, SCMA aims to position the country as a regional hub for carbon trading.

More information is available in the press release below:

Colombia Reports 36% YoY Decrease in Deforestation

Under President Gustavo Petro's administration, Colombia's deforestation levels have declined for the second consecutive year. Key strategies include compensating farmers to protect their land and agreements with armed groups to control deforestation hotspots. While progress has been made, environmental groups emphasize the importance of continued monitoring and policies for long-term forest conservation efforts. Read More

NFTs with Built-In Carbon Removal Credits

Toucan Protocol has launched an NFT collection featuring unique plant-themed digital art pieces. Each NFT is linked to 10 kg of verified and tokenized biochar carbon credits. The initiative merges art with carbon finance, showcasing the potential of blockchain technology in sustainable development. Read More

Climate Risk Assessments Shape Insurers’ Portfolios

According to AON, a growing number of insurers are integrating climate change considerations into their long-term investment decisions. By conducting climate risk assessments with various climate scenarios, adopting ESG strategies, and developing climate-aligned investment portfolios, insurers are trying to protect themselves from climate-related financial risks.

Find more detailed insights via the link below:

Enhancing Africa’s Climate Resilience with Parametric Insurance

In a recent article, the World Economic Forum (WEF) emphasizes that investing in early warning systems, parametric insurance, and their underlying climate data is crucial to mitigating climate risks in Africa. Early warning systems give communities time to prepare for extreme weather events, while parametric insurance offers rapid financial aid based on predefined triggers. Read More

Robusta Coffee as Climate-Smart Alternative to Arabica

Researchers from World Coffee Research (WCR) are examining Robusta coffee as a climate-resilient alternative to Arabica. Robusta's hardiness and ability to thrive in warmer conditions could help maintain coffee production despite climate change. This effort aims to offer a sustainable solution for coffee growers facing rising temperatures and extreme weather. Read More

First Street Secures $46M for Physical Climate Risk Modeling

First Street, a climate risk analytics firm, has raised $46 million to enhance its physical climate risk modeling capabilities. The funding will support the development of more sophisticated models and granular data for insurers, investors, and municipalities, improving flood modeling and localized risk assessments. Read More

Hurricane Beryl and AI-Driven Forecasts

In this newsletter, we have closely followed the advancements of AI-powered climate models, such as Google's GraphCast. Due to their speed and precision, these novel tools are now actively used by meteorological organizations. A recent example of GraphCast's accuracy is its prediction of Hurricane Beryl's landfall in Texas, a full four days ahead of traditional forecasting methods.

Read the full article by the NYT for more details on this development:

Hybrid Climate Model Equips East Africa for Extreme Weather

Oxford University's new hybrid climate model is focused on the Horn of Africa, a region prone to extreme weather events. Combining traditional forecasting methods with AI-driven data analysis, the model can run on a laptop yet delivers accurate rainfall predictions. The system is already utilized in Kenya and Ethiopia, improving early warnings for excess precipitation and flood risks. Read More

Updated Dataset: Tropical Moist Forests (TMF)

The European Commission's Joint Research Centre has updated the TMF dataset with data from 2023 and the reprocessed Landsat Collection 2 dataset. This update improves the accuracy of forest cover assessments in tropical regions by refining spatial resolution, classification algorithms, and cloud/haze correction techniques. Read More

Thank You For Reading Our Newsletter! 💙

We greatly appreciate your interest and support! If you enjoyed this newsletter, please consider forwarding it to your network to increase awareness of these critical climate topics.

Join the dClimate Community!

We welcome your comments, feedback, and likes. Follow us on the channels below to stay updated and start building in our decentralized climate data ecosystem. 👇

Twitter | LinkedIn | Telegram | YouTube

Learn more about dClimate's decentralized and open climate data infrastructure:

⛅ Visit our website

👉 Discover our products

💽 Access 40+ TB of free climate data via our data marketplace and API