Climate Risk Assessment for Real Estate

The real estate industry faces increasing threats from the impacts of climate change, including extreme weather events that can damage infrastructure and properties. These physical climate risks, from heatwaves to floods and hurricanes, are becoming a critical consideration for real estate businesses making investment and infrastructure development decisions. In this changing landscape, dClimate's Aegis platform is an essential tool for building climate resilience.

Key Benefits of Aegis:

- Risk Assessment and Financial Insights: Aegis provides a probabilistic view of extreme weather events and their associated financial losses. The platform helps companies gain a clearer understanding of the financial risks assets in their portfolio face, enabling more informed decisions.

- Supply Chain Resilience: The real estate industry's supply chain, encompassing construction, materials, resources, and equipment, is highly vulnerable to physical climate risks. Aegis helps businesses assess and manage these risks effectively.

- Compliance and Transparency: Meet emerging regulatory requirements and benchmarks with ease. Aegis aligns with Task-Force on Climate Related Disclosures (TCFD) physical climate risk reporting requirements, ensuring transparency to shareholders and clients.

- Investor and Client Confidence: By using Aegis to estimate potential financial losses, businesses not only gain trust from investors and clients but also enhance Global Real Estate Sustainability Benchmark (GRESB) assessments.

- Competitive Edge: In a market where climate risk is a growing concern, Aegis inputs detailed asset information, such as building materials and occupancy type, to deliver granular risk assessments. This information empowers businesses to make strategic business decisions in a competitive real estate landscape.

Case Study: Major Real Estate Investment Trust (REIT)

In this case study, we assessed physical climate risks for a large logistics real estate REIT with 1,089 property/asset locations across Asia, Europe, North America, and South America. We analyzed two climate scenarios: SSP119, assuming global sustainable development goals, and SSP585, foreseeing extreme global warming due to high greenhouse gas emissions.

Each asset, valued at $5 million, had granular details collected by Aegis, including occupancy type and construction material, for accurate vulnerability modeling. Keep in mind that uncertainty exists in Average Annual Loss (AAL) due to climate projections and exposure data, and Aegis provides these estimates to clients for a clearer understanding of potential losses.

Assessment Results for the Portfolio

While assessments were run for all the regions in the portfolio, we will focus on North America and Europe in this case study, where the majority of the assets are located.

Excessive Rainfall

Excessive rainfall resulting in potential flash flooding is the leading cause of loss and the highest risk exposure peril for assets across both North America and Europe (as well as Asia). Companies can reduce the threat of flash flooding by adopting measures like purchasing insurance to safeguard their assets. The decision to expand infrastructure in flood-prone areas is also influenced by this hazard. Conducting a physical climate risk assessment helps in making informed decisions and provides clarity to stakeholders. Real Estate Investment Trusts (REITs) should actively engage with local authorities and emergency services to establish effective flood response strategies.

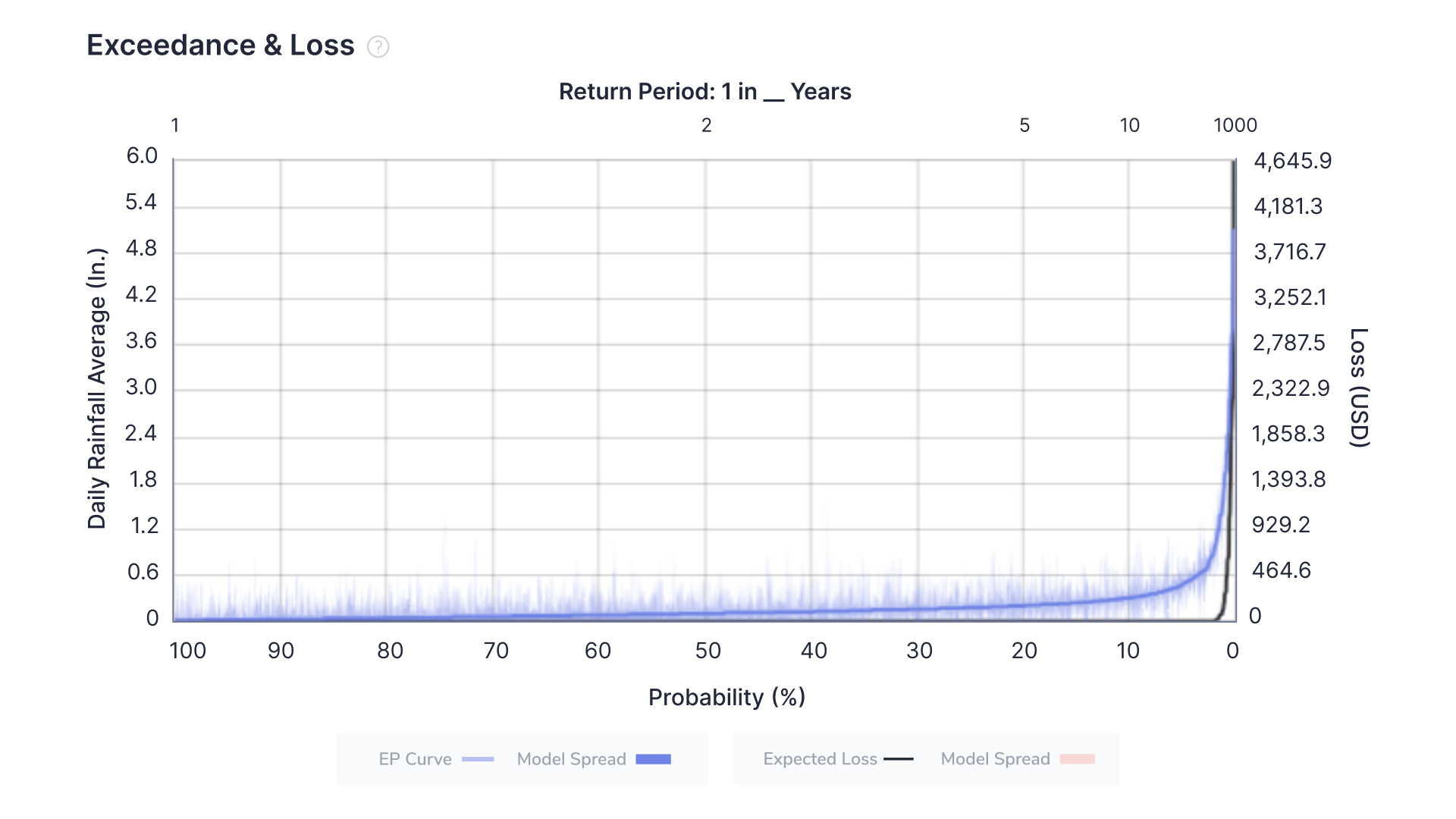

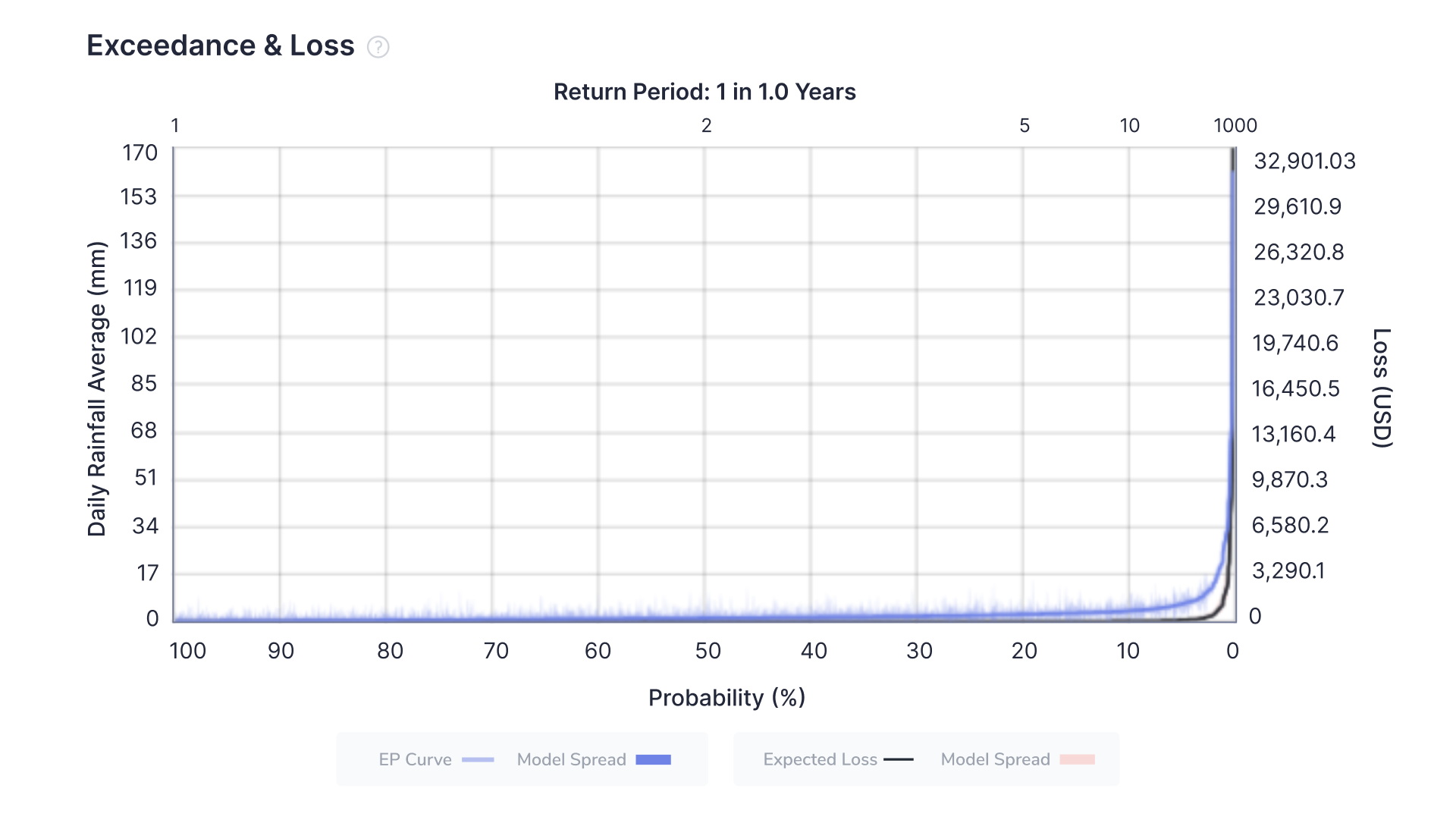

The first chart illustrates the loss and likelihood of excessive rainfall for a specific site in North America, while the second chart presents similar data for a location in Europe. Alongside flash flooding, river flooding, wildfires, and heatwaves are also major risk factors causing significant losses in these areas.

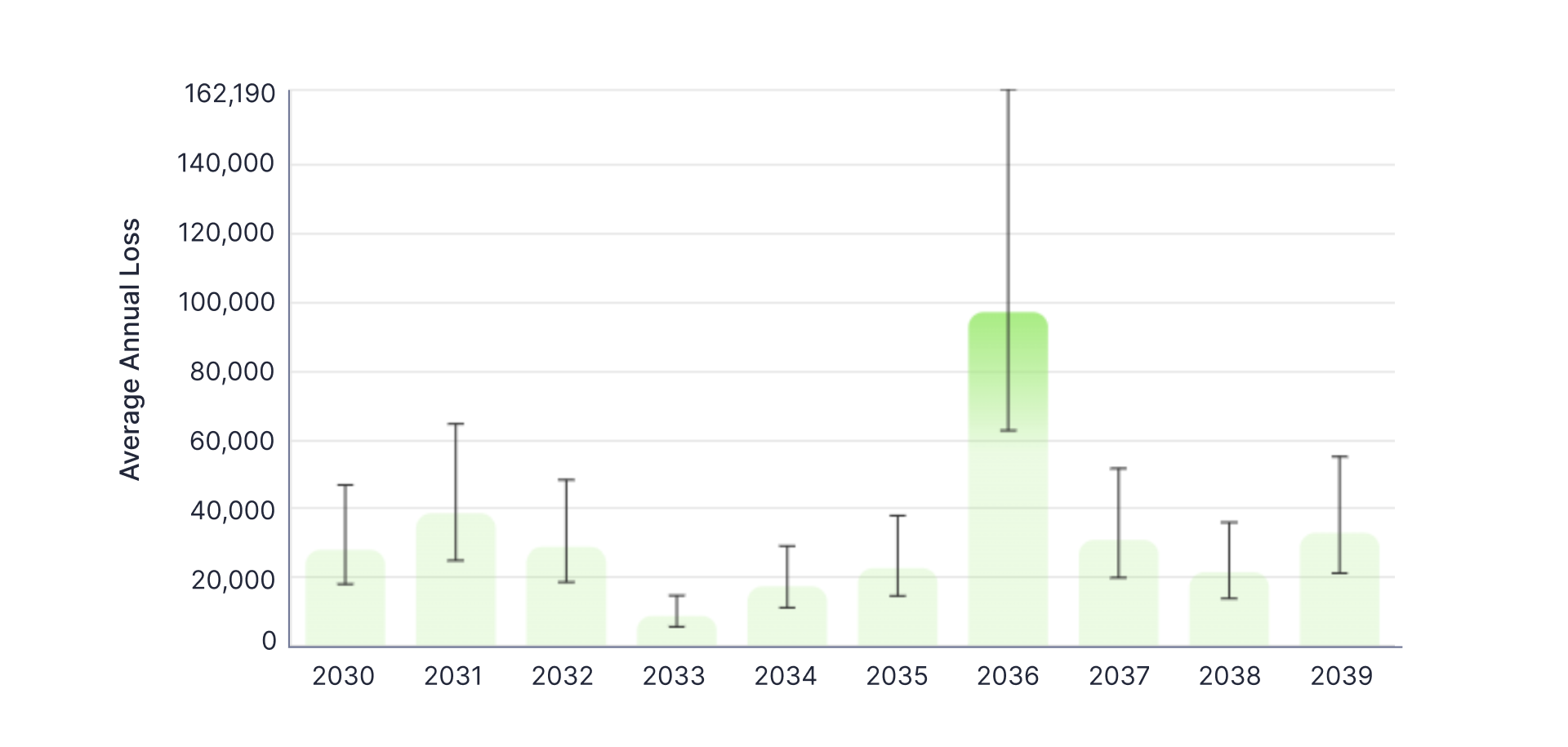

Aegis also displays detailed yearly breakdowns of losses for perils such as excessive rainfall, for individual locations. This information is vital for REITs, enabling resource management and bolstering financial health and sustainability.

River Flooding

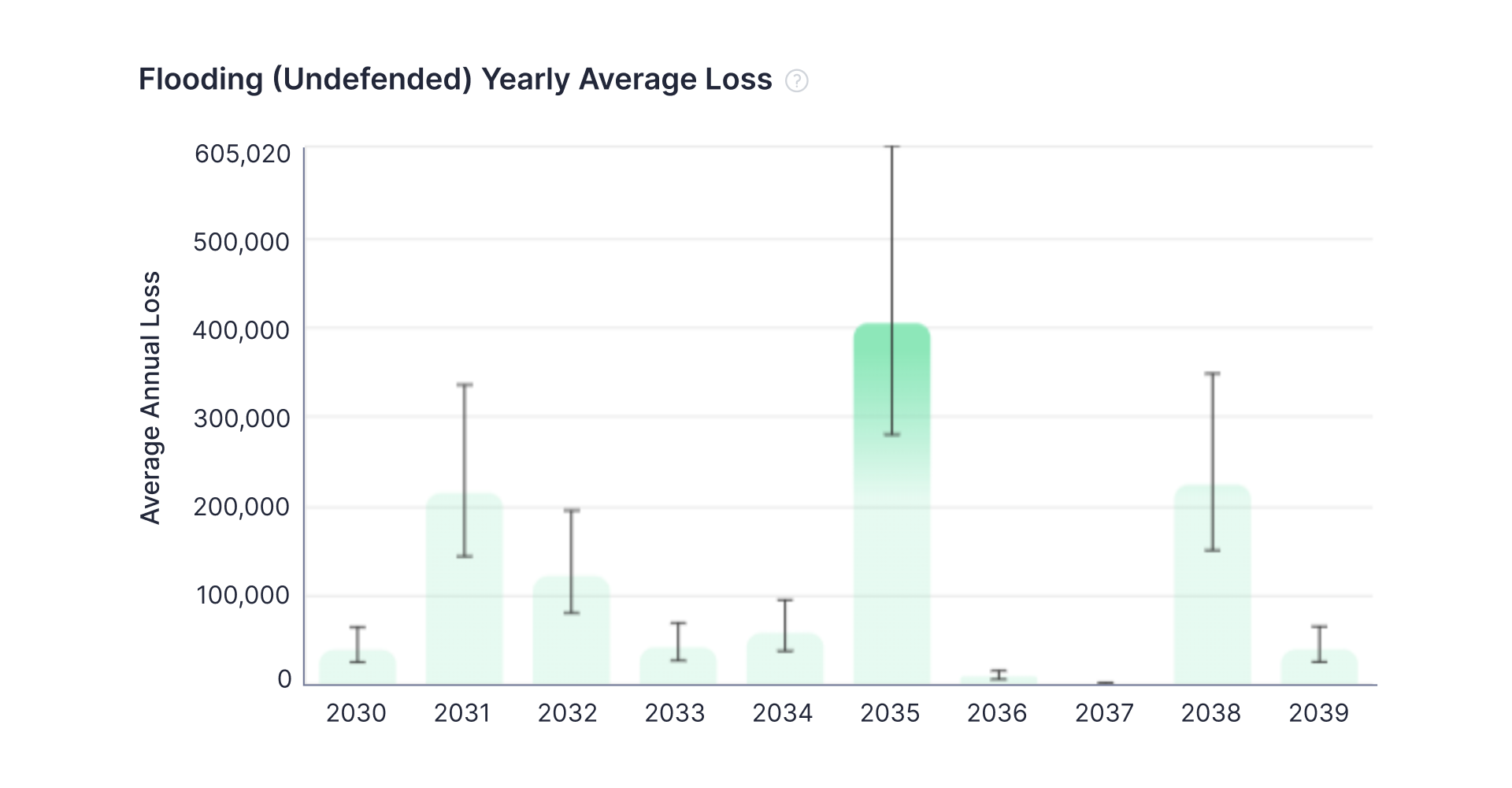

River flooding poses a significant risk to European properties in this portfolio, likely because these assets are situated closer to rivers than their North American counterparts. Businesses can respond to this risk not only by securing insurance but also by investing in flood defenses, drainage systems, and other infrastructure enhancements. This analysis also guides contingency planning, including establishing protocols for emergency responses, property evacuations, and maintaining business operations during river flood events.

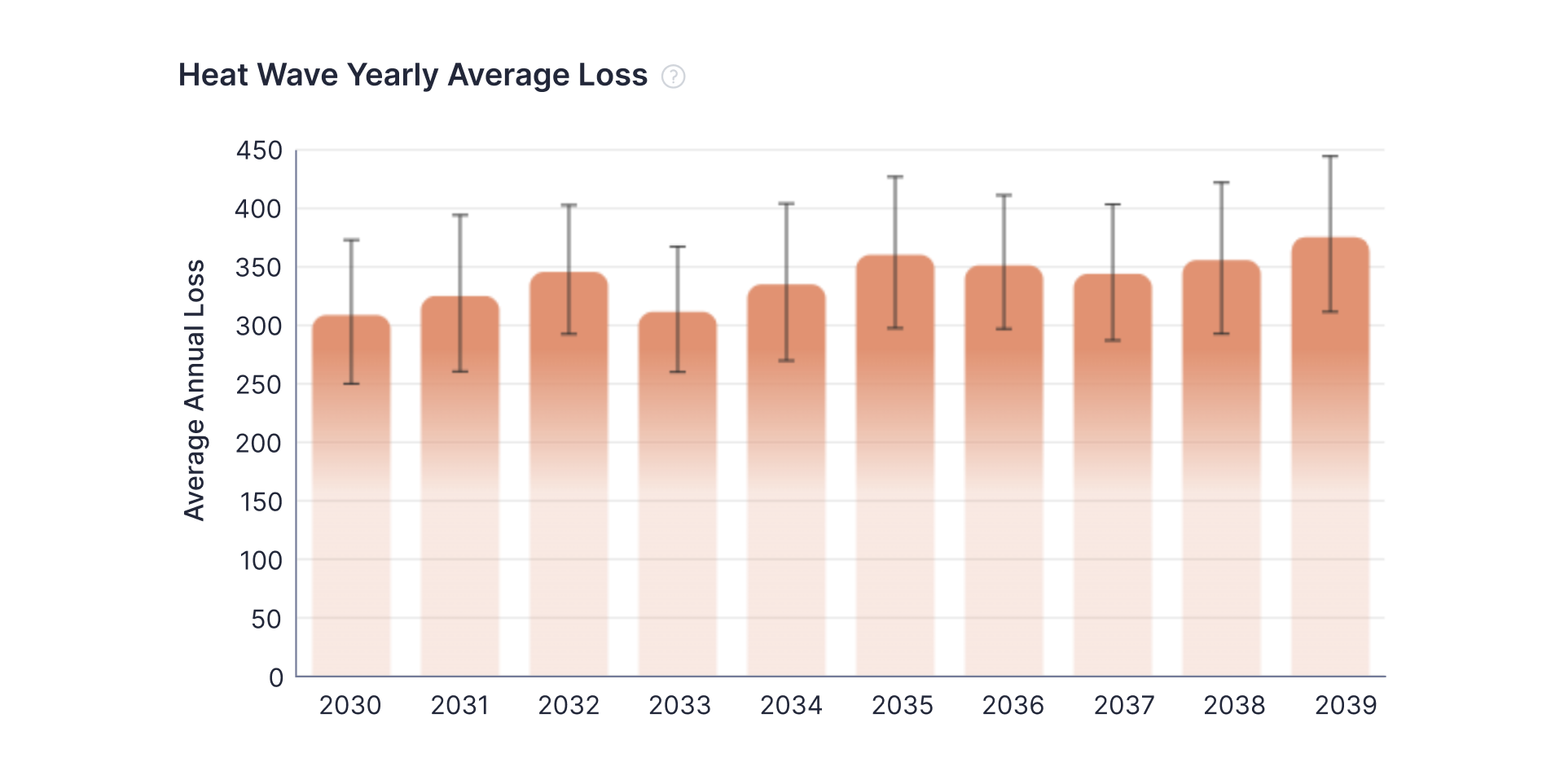

The accompanying graphic depicts annual projected losses from river flooding at a European site over a decade. Although there's no consistent pattern in losses, two out of the ten years show a substantial risk of severe flooding. Real Estate Investment Trusts (REITs) must consider this variability in flood risk when planning property maintenance, particularly in years with higher anticipated losses.

Heatwaves

Heatwaves are a high risk for assets in North America. Building on the previously discussed measures and decisions related to physical risk assessments, REITs can leverage this evaluation to enact energy-efficiency initiatives. Heatwave losses in the chart below are the projected cooling costs per year for these assets. By understanding projected cooling costs due to extreme heat, REITS can not only make properties more resilient to heat but also reduce operational costs to maintain these properties. dClimate also offers additional services to help businesses hedge climate risk due to a heatwave (see below for more information).

The chart below shows a gradual upward trend in cooling costs for the assets over the span of ten years. In response to this observable shift, REITS are prompted to take immediate action to plan for the future. This may include initiatives such as the modernization of HVAC systems or the implementation of risk-hedging strategies to counteract the impacts of climate-related risks arising from escalating temperatures and heightened occurrences of extreme heatwaves.

Additional Features

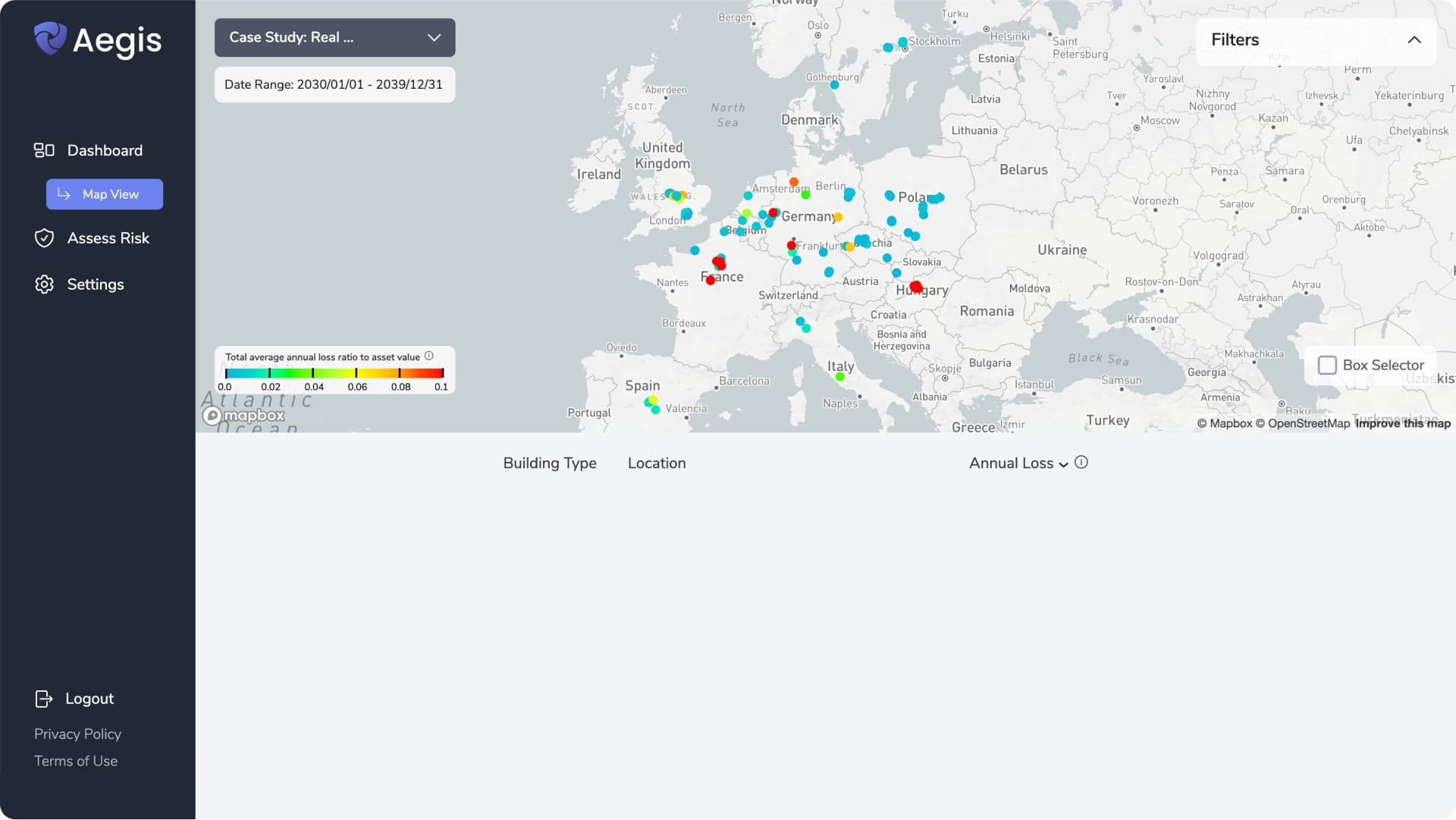

Map View

Aegis also allows for a very quick view of the portfolio in its “Map View” section, which shows the AAL in comparison to the original asset value. The map view as shown below enables quick overview of the assets that are at higher risk to specific perils.

Region-Specific Climate Risk Score Comparisons

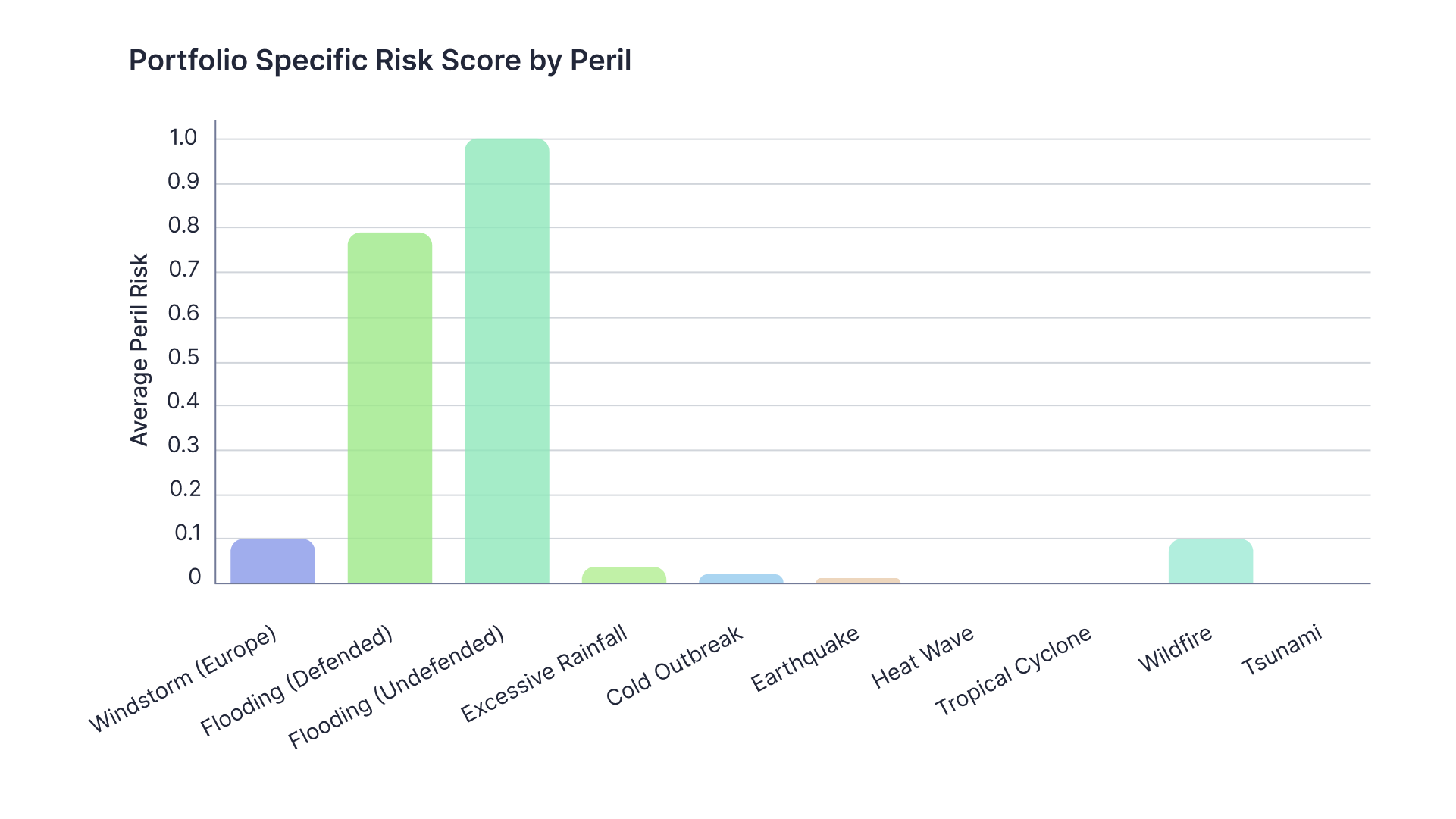

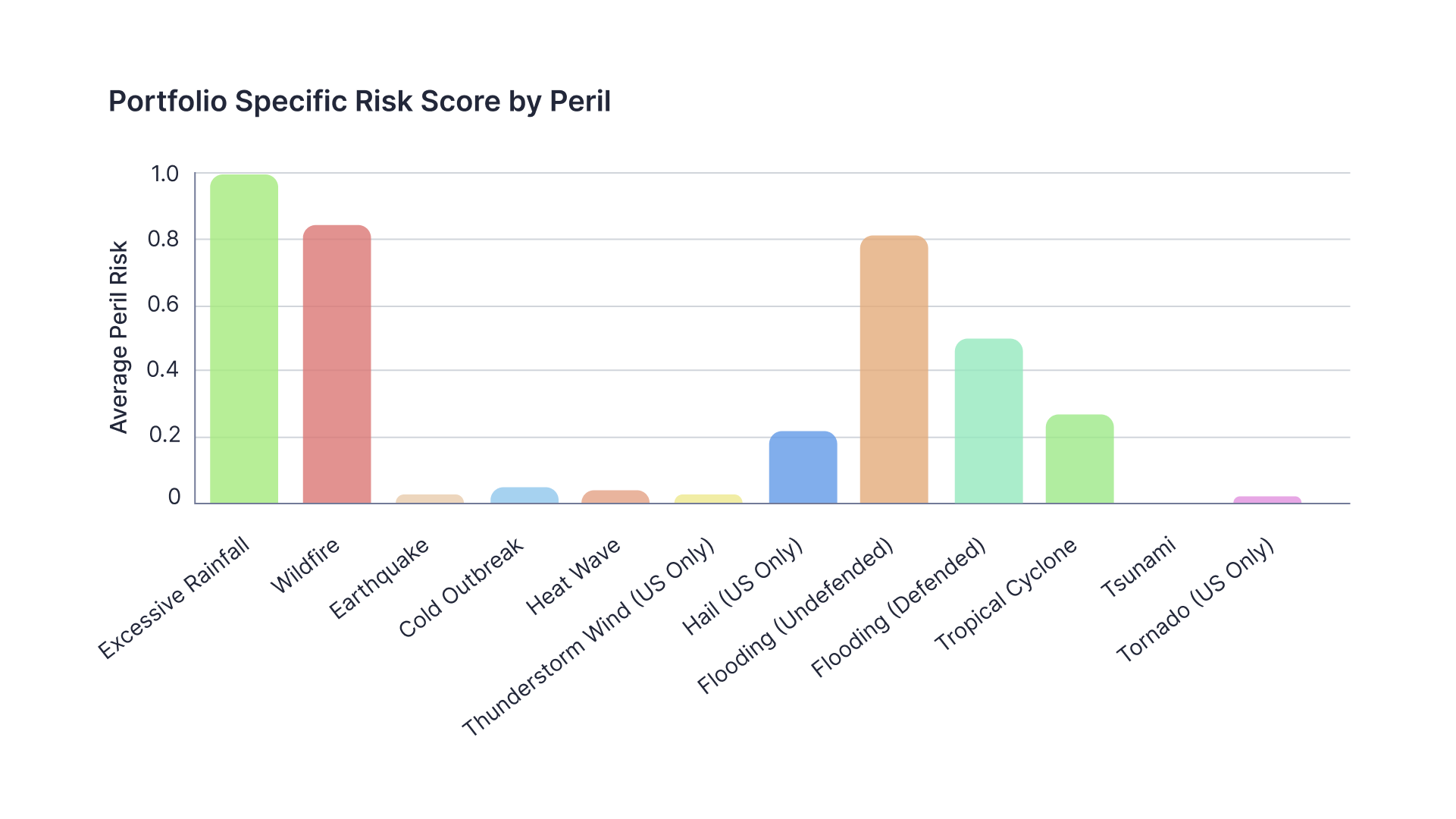

The portfolio and peril specific risk scores obtained from Aegis reports can be very useful in comparing different regions within a portfolio. Shown below are the region specific risk scores for Europe and North America for the climate scenario SSP585:

Europe

North America

Excessive Rainfall is a high risk for North America along with wildfire, but when compared to Europe, River Flooding is a higher concern for assets in that region. Converting this analysis into business decisions such as purchasing protection for wildfires may be a higher concern in North America than it is in Europe, where the risk to these assets is lower.

dClimate Value for Real Estate Corporations and REITS

dClimate's modular data infrastructure has led to the development of various climate risk solutions, offering step-by-step approaches to addressing climate hazards.

Aegis delivers a detailed analysis of physical climate risks impacting various assets, including buildings, warehouses, and residential properties, along with financial loss estimates.

Businesses can use insights from Aegis to proactively mitigate climate risks using dClimate's ecosystem solutions. For example, in a North American case study where Heatwave posed a significant risk, real estate managers can utilize dClimate's Population Weighted Heating Degree Days/Cooling Degree Days (HDD/CDD) index to hedge against heatwave risks. This index, derived from dClimate's extensive data, helps manage heatwave-related risks effectively.

Furthermore, ESG teams at Real Estate Investment Trusts (REITS) can use dClimate’s API for result verification, comparing historical weather data from the API against future projections from Aegis. In instances where Excessive Rainfall is identified as a high-risk factor, the dClimate API offers detailed precipitation data, such as the ERA5 dataset, which provides gridded global rainfall information. This data enables a thorough comparison between historical and projected future data, aiding in securing more effective insurance coverage for properties.

As a comprehensive hub for climate resilience solutions, dClimate equips businesses with necessary tools for both assessing and mitigating climate risks.

For more information about Aegis and other climate solutions, interested parties are encouraged to contact dClimate at community@dclimate.net.

🌐 Check out our website, products, and blog

💽 Explore 40+ TB of free climate data via our data marketplace and API

📰 Sign up for our bi-weekly newsletter

🥳 Join the community: Twitter | LinkedIn | Discord | Telegram | YouTube