Catastrophe Bond Market On Track to Surpass $20B | Data ReFined #58

⛅ Data ReFined is dClimate's biweekly newsletter, delivering insights at the intersection of climate risk management, the voluntary carbon market (VCM), and climate intelligence.

In this edition:

Climate Risk Management

🛡️ Catastrophe Bond Market On Track to Surpass $20B in 2025

🛡️ Report: Physical Climate Risks for Data Centres

🛡️ Why Arbol Entered the Property Insurance Market

🛡️ The Science Behind Texas’ Catastrophic Floods

🛡️ Report: Natural Catastrophes in the First Half of 2025

Carbon Finance & Digital MRV

🌳 Carbon Offset Pricing Trends

🌳 From Integrity to Compliance: The New VCM Landscape

🌳 Report: The State of European Forest Carbon Credits in 2025

Climate Data & Intelligence

🌎 Safeguarding Forest Carbon Sinks Using Emissions Data

🌎 Over 25 Years of Global Infrared Data Now Available

Scroll down for more details! 👇

Subscribe here and join over 4500+ readers!

Catastrophe Bond Market On Track to Surpass $20B in 2025

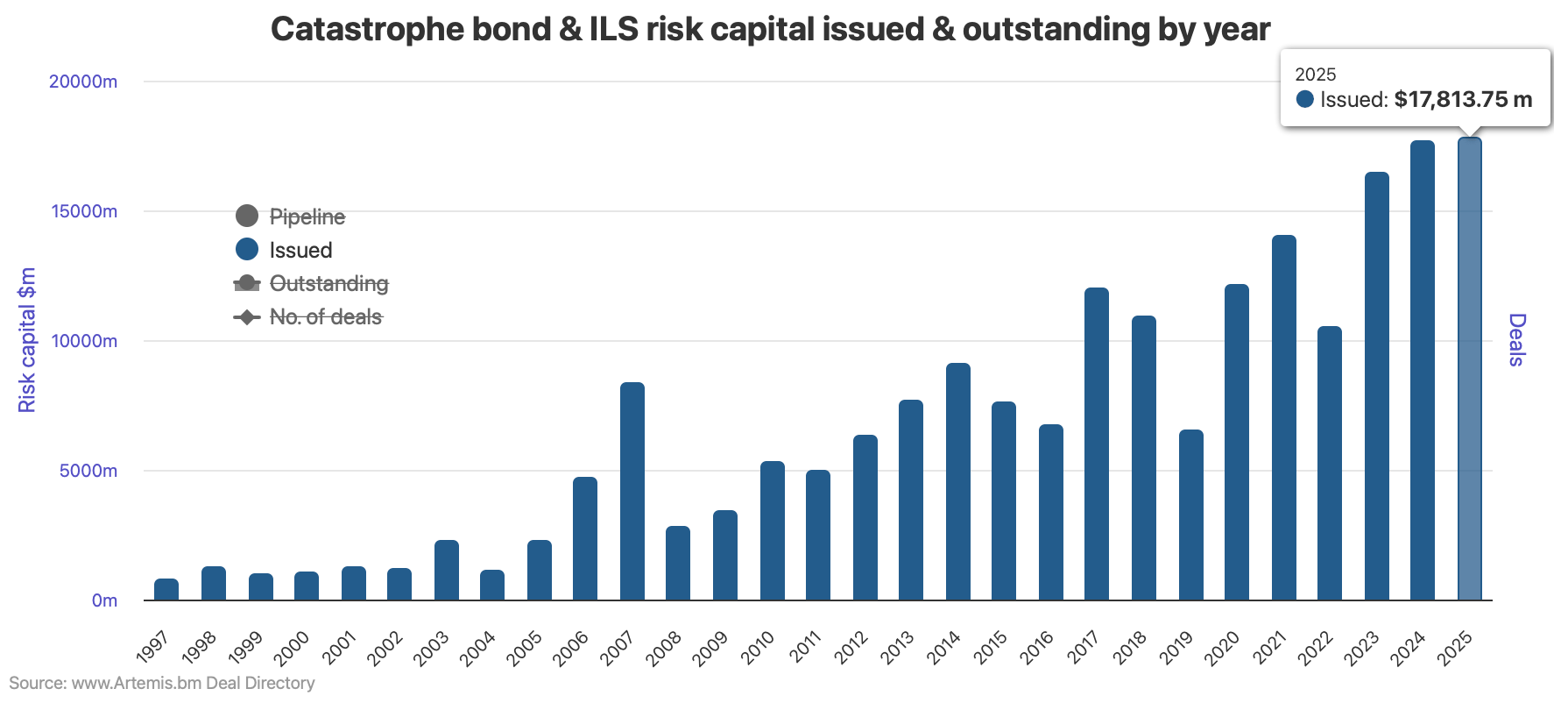

Artemis reports that cat bond issuance is on a record-breaking trajectory in 2025, with more than $17.8B already settled and more in the pipeline. A rise in both deal count and average size suggests the market is gearing up for long-term growth.

Why this matters: As climate risks intensify, scalable financial instruments like cat bonds are critical to mobilizing capital for resilience.

Report: Physical Climate Risks for Data Centres

XDI’s report analyzes nearly 9,000 data centres worldwide, mapping exposure to climate threats like flooding, cyclones, wildfires, and soil movement. With over 10% of APAC data centres already at risk, the findings underscore the urgent need to build resilience into the infrastructure that powers the digital economy. Read more →

Why Arbol Entered the Property Insurance Market

On the This Way Forward podcast, Arbol Founder and CEO Sid Jha explains why he chose to enter the collapsing property insurance market, just as major carriers were pulling out of risk-prone states like Florida and Hawaii. Listen here →

The Science Behind Texas’ Catastrophic Floods

Grist’s analysis identifies how rising Gulf moisture, extreme heat, and slow-moving thunderstorms converged to produce record rainfall over fragile limestone terrain, resulting in tragic flash floods in Texas’s Hill Country. The lack of robust flood warning systems compounded the loss. Read more →

That same sudden, intense, and hyperlocal flood risk is also largely invisible in FEMA’s official flood zones, according to a recent article examining how U.S. mapping lags behind climate reality. This gap leaves many homeowners unaware and unprepared. Read more →

Report: Natural Catastrophes in the First Half of 2025

Gallagher Re estimates $151 billion in catastrophe-related economic losses for H1 2025, with $84 billion insured. These numbers showcase that climate risks are accelerating faster than financial systems can respond. Climate intelligence and innovative insurance models are essential for closing the gap. Read more →

Carbon Offset Pricing Trends

Sylvera’s mid‑2025 analysis lays out price benchmarks for 2025, showing nature-based credits like ARR ($24/tCO₂) and REDD+ ($7/tCO₂) trading far below removal credits like DAC (> $500/tCO₂), biochar ($177), and BECCS ($389).

Why it matters: Understanding these trends helps market players pivot toward high‑integrity credits as VCM transparency intensifies.

From Integrity to Compliance: The New VCM Landscape

According to William Theisen from Schneider Electric, voluntary carbon markets are evolving into compliance-oriented systems, driven by ICVCM’s Core Carbon Principles, VCMI’s Claims Code, CORSIA, and Article 6 frameworks. This convergence is reshaping what qualifies as a credible credit, with integrity standards now becoming prerequisites for buyers. Read more →

Report: The State of European Forest Carbon Credits in 2025

Arbonics’ report dissects the European forest carbon ecosystem, covering standards, pricing, supply constraints, and the leading credit buyers and developers. Read more →

Safeguarding Forest Carbon Sinks Using Emissions Data

With 30-meter-resolution carbon maps from Land & Carbon Lab, UNESCO can now detect whether each forested World Heritage site is acting as a sink or a source.

Why it matters: These insights are helping mobilize funding, shape policy, and reduce response times when fire or deforestation strikes.

Over 25 Years of Global Infrared Data Now Available

NASA now offers over 25 years of 4 km-resolution thermal infrared data dating back to 1998, available via its global dataset. This high-frequency, high-resolution archive enables better tracking of cloud systems, storm development, and temperature patterns critical for climate risk assessment. Read more →

Thank You For Reading Our Newsletter! 💙

We greatly appreciate your interest and support! If you enjoyed this newsletter, please consider forwarding it to your network to increase awareness of these critical climate topics.

About dClimate

dClimate’s decentralized and open climate data infrastructure powers a wide range of solutions, including climate risk assessments, parametric insurance, and climate intelligence platforms for carbon and commodity markets.

⛅ Visit our website | 📊 Discover our climate tech solutions

Join the Mission

We welcome your comments, feedback, and likes. Follow us on the channels below to stay updated and start exploring our open climate data ecosystem. 👇